Introduction

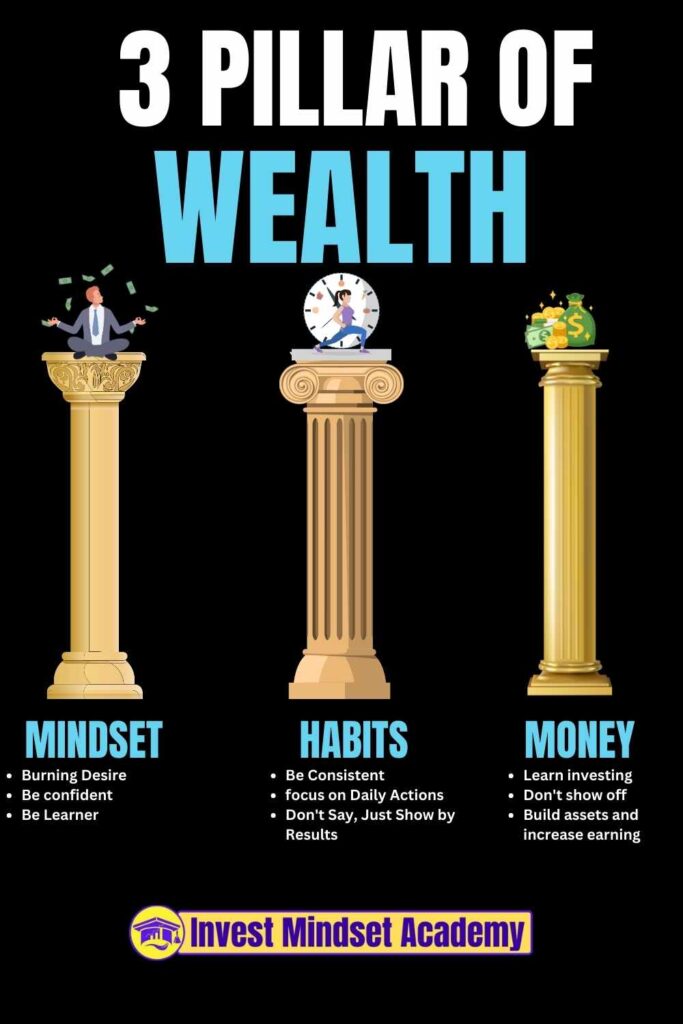

Hello, dear readers! Today, I want to share something very special with you all. It’s about building wealth, but not just in terms of money. Wealth, in its truest sense, encompasses much more. It’s about having a fulfilling life, financial stability, and a mindset that attracts abundance. In this blog, we will explore the 3 pillars of wealth: Mindset, Habits, and Money. Let’s dive in!

The 3 Pillars of Wealth: Mindset, Habits, and Money

1. Mindset: The Foundation of Wealth

Burning Desire

First and foremost, having a burning desire to achieve your goals is crucial. This desire is what keeps you motivated and focused. It’s the spark that lights the fire within you. Think about what you truly want in life. Whether it’s financial freedom, a successful career, or a peaceful life, your desire will drive you forward.

Be Confident

Confidence plays a huge role in achieving wealth. Believe in yourself and your abilities. When you are confident, you take bolder steps and are not afraid to face challenges. Remember, every successful person has faced failures. What sets them apart is their confidence to keep going.

Be a Learner

The world is constantly changing, and so should you. Be a lifelong learner. Read books, attend seminars, take online courses, and learn from others. The more knowledge you gain, the better equipped you are to make informed decisions and seize opportunities.

2. Habits: The Daily Actions that Lead to Success

Be Consistent

Consistency is key to building wealth. It’s not about making big changes overnight but about making small, consistent efforts every day. Whether it’s saving money, investing, or learning something new, consistency will yield results over time.

Focus on Daily Actions

Your daily actions determine your future. Make a habit of setting goals for the day and sticking to them. Prioritize tasks that bring you closer to your long-term goals. It could be as simple as saving a small amount of money every day or spending an hour learning about investments.

Don’t Say, Just Show by Results

Actions speak louder than words. Instead of talking about your plans, focus on executing them. Let your results do the talking. When people see your success, it will speak volumes about your dedication and hard work.

3. Money: Managing and Growing Your Wealth

Learn Investing

One of the most important aspects of building wealth is learning how to invest. Investing is not just about putting your money into stocks or real estate; it’s about understanding where and how to grow your money. Start by learning the basics of different investment options. Take small steps and gradually expand your investment portfolio.

Don’t Show Off

In today’s world, it’s easy to get caught up in showing off wealth. However, true wealth is quiet. It’s not about flaunting expensive cars or gadgets but about having financial security and peace of mind. Focus on building real wealth instead of impressing others.

Build Assets and Increase Earnings

Building assets is a crucial part of growing wealth. Assets are things that put money in your pocket, such as investments, real estate, or a business. Focus on acquiring assets that appreciate over time. Additionally, look for ways to increase your earnings. This could be through a side business, freelancing, or upgrading your skills to get a better job.

Practical Steps to Implement These Pillars

Develop a Positive Mindset

- Affirmations: Start your day with positive affirmations. Remind yourself of your goals and your ability to achieve them.

- Visualization: Visualize your success. Imagine yourself achieving your goals and living the life you desire.

- Surround Yourself with Positivity: Be around people who uplift and inspire you. Avoid negative influences that drain your energy and confidence.

Build Effective Habits

- Morning Routine: Have a productive morning routine. Exercise, meditate, or read to start your day on a positive note.

- Set Daily Goals: Break down your long-term goals into daily tasks. This makes them more manageable and achievable.

- Review Your Progress: Regularly review your progress. Reflect on what’s working and what’s not. Make adjustments as needed.

Manage and Grow Your Money

- Budgeting: Create a budget and stick to it. This helps you manage your expenses and save more money.

- Emergency Fund: Have an emergency fund for unexpected expenses. This gives you financial security and peace of mind.

- Invest Wisely: Start investing early. Learn about different investment options and choose the ones that suit your risk tolerance and financial goals.

Conclusion

Building wealth is a journey that requires a strong mindset, consistent habits, and smart money management. It’s not about getting rich quick but about creating a life of abundance and financial stability. Remember, the journey of a thousand miles begins with a single step. Start implementing these pillars in your life today, and you’ll be on your way to building true wealth.

Thank you for reading! If you found this blog helpful, please share it with others. Let’s spread the knowledge and help everyone achieve financial freedom and a prosperous life.

Feel free to leave your thoughts and questions in the comments below. I’d love to hear from you and help you on your journey to wealth!

What are the three pillars of wealth?

The three pillars of wealth are:

Mindset: Developing a strong, positive mindset that includes a burning desire for success, confidence, and a willingness to learn.

Habits: Establishing consistent daily actions that align with your long-term goals, such as being consistent, focusing on daily tasks, and showing results through actions.

Money: Learning how to manage and grow your wealth through smart investing, avoiding unnecessary show-offs, and building assets to increase earnings.

Why is mindset important in building wealth?

A strong mindset is crucial because it:

Motivates you: A burning desire to achieve your goals keeps you focused and driven.

Builds confidence: Believing in yourself helps you take bold steps and overcome challenges.

Encourages learning: A willingness to learn equips you with the knowledge needed to make informed decisions and seize opportunities.

How can I develop a positive mindset?

You can develop a positive mindset by:

Practicing affirmations: Start your day with positive statements about yourself and your goals.

Visualization: Imagine yourself achieving your goals and living the life you desire.

Surrounding yourself with positivity: Spend time with people who uplift and inspire you and avoid negative influences.

What are some effective habits for building wealth?

Effective habits for building wealth include:

Consistency: Making small, regular efforts towards your goals.

Daily goal setting: Breaking down long-term goals into daily tasks.

Reviewing progress: Regularly reflecting on what’s working and making adjustments as needed.

How can I manage my money better?

To manage your money better, you should:

Create a budget: Plan your income and expenses to manage your finances effectively.

Build an emergency fund: Save money for unexpected expenses to ensure financial security.

Invest wisely: Start investing early, learn about different investment options, and choose those that align with your risk tolerance and financial goals.

What is the significance of investing in building wealth?

Investing is significant because:

It grows your money: Investments can appreciate over time, increasing your wealth.

It diversifies income: Different investments provide various sources of income.

It builds assets: Investments in assets like real estate or stocks can provide financial stability and security.

Why is it important not to show off wealth?

It’s important not to show off wealth because:

True wealth is quiet: Financial security and peace of mind are more valuable than impressing others.

Focus on real growth: Concentrating on building real wealth rather than temporary displays ensures long-term financial stability.

Avoid unnecessary expenses: Showing off can lead to spending money on things that don’t contribute to your wealth.

How can I build assets?

You can build assets by:

Investing in real estate: Buying property that appreciates over time.

Investing in stocks and bonds: Diversifying your portfolio with financial instruments that grow.

Starting a business: Creating a venture that generates income and grows in value.

What daily actions can I take to build wealth?

Daily actions to build wealth include:

Saving a portion of your income: Regularly setting aside money for savings and investments.

Learning something new: Dedicating time each day to learn about investments, personal finance, or skills that can increase your earning potential.

Reviewing financial goals: Regularly checking your progress towards your financial goals and making necessary adjustments.

How can I start implementing these pillars in my life today?

To start implementing these pillars in your life today:

Mindset: Begin with daily affirmations, visualize your success, and seek positive influences.

Habits: Establish a productive morning routine, set daily goals, and consistently review your progress.

Money: Create a budget, start building an emergency fund, and begin learning about investment options.

1 thought on “The 3 Pillars of Wealth: Mindset, Habits, and Money”