Budgeting is the foundation of financial success. It helps you control your money, make better financial decisions, and achieve your goals faster. But many people find budgeting overwhelming or confusing. The good news is that budgeting doesn’t have to be complicated. By following some simple tips, you can save more money every month and gain peace of mind.

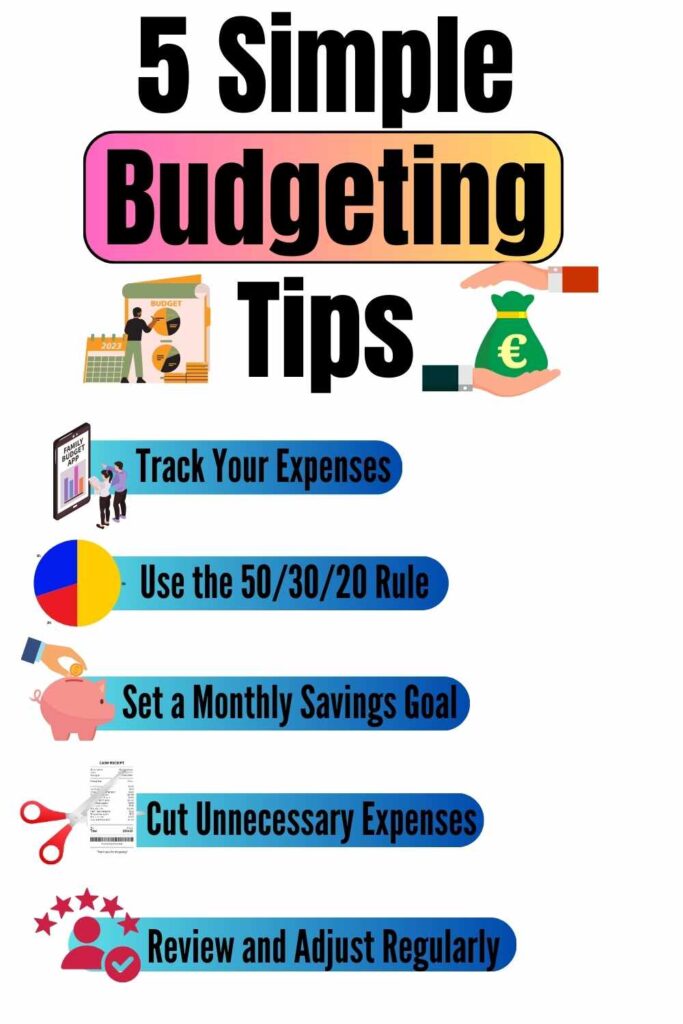

Here are five straightforward budgeting tips that anyone can implement, regardless of their financial situation.

1. Track Your Expenses

Why Tracking is Important: The first step to successful budgeting is knowing exactly where your money is going. It’s easy to lose track of small purchases, but these can add up over time. By tracking your expenses, you get a clear picture of your spending habits, allowing you to identify areas where you can cut back and save more.

How to Track Your Expenses:

- Use a Budgeting App: There are many apps available that can automatically track your spending by linking to your bank account. These apps categorize your expenses and provide detailed reports, making it easy to see where your money is going.

- Maintain a Spending Journal: If you prefer a more hands-on approach, keep a journal where you write down every purchase you make. This old-school method can be very effective in making you more aware of your spending.

- Review Bank Statements: Go through your bank and credit card statements at the end of each month. Highlight or note down purchases that were unnecessary or that you could have avoided.

Quick Tip: Start by tracking your expenses for at least one month to get an accurate picture of your spending habits.

You may also Read

2. Set a Monthly Savings Goal

Why Setting Goals Matters: Saving money becomes easier when you have a clear goal in mind. Whether it’s building an emergency fund, saving for a vacation, or putting money aside for a big purchase, having a specific target helps you stay motivated and focused.

How to Set a Savings Goal:

- Determine the Amount: Decide how much you want to save each month. It could be a percentage of your income or a fixed amount that fits your budget.

- Automate Your Savings: Set up an automatic transfer from your checking account to your savings account on payday. This ensures that you save first before spending on other things.

- Break It Down: If your goal seems too large, break it down into smaller, more manageable steps. For example, if you want to save $1,200 a year, aim to save $100 each month.

Quick Tip: Start with a realistic goal and gradually increase your savings as you get more comfortable with your budget.

3. Use the 50/30/20 Rule

Why This Rule Works: The 50/30/20 rule is a simple budgeting framework that helps you allocate your income in a balanced way. By following this rule, you can cover your essentials, enjoy your life, and still save for the future without feeling restricted.

How to Apply the 50/30/20 Rule:

- 50% for Needs: Allocate 50% of your income to essential expenses like rent, utilities, groceries, and transportation. These are the expenses you must pay to live.

- 30% for Wants: Dedicate 30% of your income to discretionary spending, such as dining out, entertainment, hobbies, and other non-essential purchases. This is your “fun money.”

- 20% for Savings and Debt Repayment: Use 20% of your income to build your savings, invest, or pay off debts. This portion is crucial for securing your financial future.

Quick Tip: If your needs take up more than 50% of your income, try to adjust your wants or savings accordingly, or look for ways to reduce your essential expenses.

4. Cut Unnecessary Expenses

Why Cutting Expenses is Key: One of the easiest ways to save more money is by cutting out unnecessary expenses. Often, we spend money on things we don’t really need or even notice. By identifying and eliminating these costs, you can free up more money to save or invest.

How to Cut Unnecessary Expenses:

- Review Your Subscriptions: Cancel any subscriptions or memberships you don’t use regularly, such as streaming services, gym memberships, or magazine subscriptions.

- Cook at Home: Eating out frequently can be costly. Try cooking more meals at home and bring lunch to work to save money.

- Reduce Utility Bills: Save on electricity, water, and gas by being mindful of your usage. Simple actions like turning off lights when not in use and fixing leaks can add up.

- Avoid Impulse Purchases: Before making a purchase, ask yourself if it’s something you need or just want. Waiting 24 hours before buying can help you make more mindful spending decisions.

Quick Tip: Make a list of your regular expenses and see which ones you can reduce or eliminate altogether.

5. Review and Adjust Regularly

Why Regular Reviews Matter: Budgeting isn’t a one-time task. Your financial situation and goals may change over time, so it’s important to regularly review your budget and make adjustments as needed. This ensures that your budget stays relevant and effective in helping you save money.

How to Review and Adjust Your Budget:

- Set a Monthly Review Date: Pick a specific day each month to go over your budget. Look at your income, expenses, and savings to see if you’re on track.

- Adjust for Changes: If your income increases, consider increasing your savings goals. If you have new expenses, find ways to accommodate them by cutting back elsewhere.

- Celebrate Milestones: Recognize when you’ve reached a savings milestone or successfully reduced an expense. Celebrating these achievements can keep you motivated.

Quick Tip: Keep a flexible mindset and be willing to tweak your budget as your life circumstances change.

Conclusion: Simplifying Your Budgeting Process

Budgeting doesn’t have to be a daunting task. By tracking your expenses, setting realistic savings goals, following the 50/30/20 rule, cutting unnecessary costs, and regularly reviewing your budget, you can take control of your finances and start saving more money each month.

Remember, the key to successful budgeting is consistency. Stick to these tips, and over time, you’ll see your savings grow and your financial stress decrease. Start today, and take the first step towards a more secure and prosperous financial future.