Are you one of those folks who feel a little lost when someone starts talking about income tax savings? Don’t worry; you’re not alone. Many of us, especially those who are new to the world of earning, often find ourselves scratching our heads, trying to figure out how income taxes saving strategies work. And yes, there might be some people (like me) who might chuckle at this confusion, but hey, that’s no reason to stop asking questions. In fact, not asking could be worse. So, let’s dive into the basics of income taxes, break them down into simple terms, and maybe, just maybe, uncover some strategies to save on those taxes legally

You May Read –Mastering Your Finances: The Ultimate Guide to Saving and Investing Smartly

[ez-toc]

Understanding Income Tax Income Tax savings in India

The Concept of Income Tax

Income tax is a tax levied by the government on the income earned by individuals and entities within its jurisdiction. The fundamental principle behind income tax is the ability to pay, meaning those who earn more pay more tax, making it a progressive financial obligation. The government uses the revenue generated from income taxes to fund public services, infrastructure, defense, and welfare programs.

In India, the income tax system operates on a slab system, where the rate of taxation increases as the income of the individual increases. For instance, as of the current tax slabs, individuals earning up to ₹2.5 lakh per annum are exempt from paying income tax. Beyond this exemption limit, different tax rates apply based on income brackets, which are periodically revised in the government’s annual budget.

Significance of Income Tax

Once an individual starts earning more than the specific threshold (for example, ₹5 lakh per annum), paying income tax becomes mandatory. The significance of understanding and paying income tax lies in:

- Legal Compliance: It’s a legal requirement to file income tax returns if your income exceeds the exempted limit. Non-compliance can lead to penalties and legal issues.

- Financial Discipline: Regularly filing income tax returns encourages financial discipline, helping individuals keep a detailed account of their income, investments, and expenditures.

- Credit/Visa Applications: A history of timely filed income tax returns is often required when applying for loans, credit cards, or visas, as it serves as proof of income.

- Refunds: If you’ve paid more tax than you owe (through TDS, for example), filing a return helps you claim a refund.

- Contribution to Development: The taxes collected are used for the development of the country, including infrastructure, education, and healthcare.

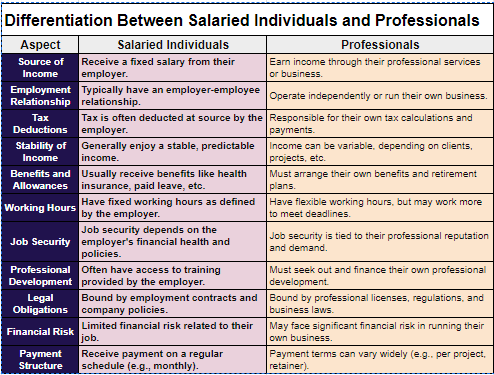

Differentiation Between Salaried Individuals and Professionals

The tax obligations in India slightly vary between salaried individuals and professionals (such as doctors, lawyers, freelancers):

- Salaried Individuals: For those employed with an organization, the employer deducts tax at source (TDS) based on the employee’s income slab before disbursing the salary. These individuals receive a Form 16 from their employer, detailing the income earned and the tax deducted, which simplifies filing their income tax returns.

- Professionals and Freelancers: Professionals and freelancers, on the other hand, must estimate their annual income and pay advance tax in quarterly installments if their tax liability exceeds ₹10,000 in a financial year. They are responsible for maintaining detailed accounts of their income, expenses, and investments to calculate their tax liability. They do not have TDS deducted monthly but must comply with GST regulations if their earnings exceed the threshold for GST registration.

So, Understanding taxes in India is crucial for anyone who earns income, as it is a legal obligation to pay taxes on your earnings above a certain threshold. Income tax is a direct tax levied on the income of individuals, corporations, and other entities by the government. In India, the income tax system operates on a progressive basis, meaning that the tax rate increases as the income level goes up.

Here’s a breakdown of the basics of income tax in India:

Income Tax Threshold:

The income tax threshold is the minimum amount of income a person can earn before they are required to pay taxes. In India, for individuals below the age of 60, the basic exemption limit is Rs. 2.5 lakh per annum (for FY 2022-23). However, once an individual’s income exceeds this threshold, they are obligated to pay taxes on the excess amount.

Tax Slabs:

India has different tax slabs based on income levels. As of FY 2022-23, the tax slabs for individuals below the age of 60 are as follows:

- Income up to Rs. 2.5 lakh: No tax

- Income between Rs. 2.5 lakh to Rs. 5 lakh: 5%

- Income between Rs. 5 lakh to Rs. 10 lakh: 20%

- Income above Rs. 10 lakh: 30%

Examples:

- If a salaried individual earns Rs. 6 lakh per annum, they fall under the 20% tax slab. They would have to pay 5% tax on the income between Rs. 2.5 lakh to Rs. 5 lakh and 20% tax on the income between Rs. 5 lakh to Rs. 6 lakh. he can file a return detailing their salary, deductions under various sections (like 80C, 80D), and any other income.

- A freelance graphic designer earning Rs. 8 lakh per annum would fall under the 30% tax slab. They would be responsible for calculating their taxes and paying them to the government. Additionally, they can claim deductions under various sections to reduce their taxable income and tax liability.

The Process of Tax Deducted at Source (TDS) for Salaried Employees

TDS is a means of collecting income tax in India, under the Indian Income Tax Act of 1961. It is managed by the Central Board for Direct Taxes and is part of the Department of Revenue managed by the Indian Ministry of Finance. TDS is applicable to various incomes including salaries, interest payments, commissions, rent, and other such incomes.

For salaried employees, the process of TDS begins with the employer estimating the total income of the employee for the financial year. This estimation includes salary, bonuses, and any other income that might be applicable. Based on this estimated total income, the employer calculates the tax liability of the employee according to the income tax slabs that are in place for that financial year.

Role of Employers in Tax Deduction

Employers play a critical role in the process of TDS for salaried individuals. Their responsibilities include:

Tax Deducted at Source (TDS) for Salaried Employees:

- Tax Deducted at Source (TDS) is a system introduced by the Income Tax Department to collect tax at the source of income. It is applicable to various incomes such as salaries, interest, rent, commission, etc.

- For salaried employees, TDS is deducted by the employer from the salary paid to the employee each month. The employer is responsible for deducting TDS as per the income tax slab rates applicable to the employee’s income.

- TDS is deducted based on the employee’s estimated tax liability for the financial year. The employer considers various factors such as salary, exemptions, deductions, etc., to determine the amount of TDS to be deducted from the employee’s salary.

Responsibilities of Employers in Calculating and Deducting Tax:

- Employers are required to calculate the amount of TDS to be deducted from the employee’s salary based on their income, exemptions, deductions, and the prevailing income tax slab rates.

- They must deduct TDS from the salary payable to the employee each month before making the payment.

- Employers need to issue Form 16 to employees at the end of the financial year, which provides details of the salary paid and the TDS deducted during the year.

- Employers are also responsible for depositing the TDS amount deducted from the employees’ salaries with the government within the specified due dates.

Assisting Employees with Tax-Saving Proofs:

- Employers play a crucial role in assisting employees with tax-saving proofs and declarations. They provide employees with various tax-saving options such as investments in Provident Fund (PF), National Pension System (NPS), Equity Linked Saving Schemes (ELSS), etc.

- Employers collect investment proofs and declarations from employees to consider them for tax deduction purposes. These proofs include documents such as rent receipts, medical insurance premium receipts, investment proofs, etc.

- Based on the investment proofs submitted by employees, employers adjust the TDS deductions to ensure that employees receive the benefit of tax deductions under various sections of the Income Tax Act.

Example of Tax Deduction Process

Let’s consider an example to understand the role of employers in tax deduction.

Suppose Mr. A works as a salaried employee in XYZ Company with a monthly salary of Rs. 70,000 ( Yearly Income 8,40,000). As per the income tax slab rates, his estimated tax liability for the financial year is Rs. 80,500. Therefore, the employer deducts TDS of Rs. 6,700 (assuming a 20% tax rate) from Mr. A’s salary each month before making the payment.

Additionally, Mr. A submits investment proofs such as Provident Fund contribution, Life Insurance premium receipts, Investment and Rent receipts to his employer. Based on these proofs, the employer adjusts Mr. A’s TDS deductions as per Tax law (like INR 1,50,000 under Section 80C) and issues him Form 16 at the end of the financial year.

I will talk about Tax Saving In later, so Keep reading to understand whole concepts

So, Employers play a crucial role in deducting TDS from the salaries of employees, calculating the tax liability, and assisting them with tax-saving options and proofs. Understanding these responsibilities is essential for both employers and employees to ensure compliance with tax laws and optimize tax savings.

The Role of HR in Tax Deductions and Submissions

- Tax Deduction at Source (TDS) Management: HR departments are responsible for managing Tax Deduction at Source (TDS) for employees. This involves deducting tax from your salary before it is paid to you, based on the projected annual income and applicable tax slabs. HR ensures that the right amount of tax is deducted, considering various deductions and exemptions you’re eligible for under sections like 80C, 80D, etc.

- Investment Declaration Process: At the beginning of the financial year, HR departments collect investment declarations from employees. This declaration includes details of planned investments and expenses eligible for tax deductions. Based on this, HR calculates the taxable income and adjusts the TDS accordingly, helping employees in tax planning and saving. Example: If an employee plans to invest INR 1,50,000 in a Public Provident Fund (PPF), which is eligible for deduction under Section 80C, HR will consider this investment while calculating the TDS, thereby reducing the taxable income and the amount of tax deducted each month.

- Providing Form 16: Form 16 is a certificate issued by employers, providing a detailed breakdown of the salary paid and the tax deducted during the financial year. HR departments ensure that Form 16 is accurately prepared and issued to employees on time, which is essential for filing income tax returns.

- Assisting with Tax Filing: While it’s not their direct responsibility, many HR departments go a step further by organizing tax filing sessions or workshops. They may also tie up with professional tax consultants to provide assistance to employees. This helps especially those who are new to tax filing understand the process and comply with the tax laws efficiently.

- Handling Reimbursements and Tax-Exempt Allowances: HR also manages reimbursements and allowances that are exempt from tax, such as travel allowance, house rent allowance (HRA), medical insurance premiums, etc. They ensure that these exemptions are properly accounted for in the employee’s salary structure, optimizing the tax benefits.

- Updating Employees on Tax Laws: Tax laws and slabs can change with each budget announcement. HR departments keep themselves updated with these changes and inform employees about how these changes might affect their taxation and salary. This information is crucial for employees to make informed decisions about their investments and tax-saving strategies.

The efforts of the HR department significantly ease the burden of understanding and managing taxes for employees. By efficiently handling TDS, assisting in tax planning through investment declarations, providing essential documents like Form 16, and even helping with tax filing, HR plays a pivotal role in ensuring employees are not only compliant with the tax laws but also able to optimize their tax savings. It’s essential for employees to recognize and appreciate the intricate work HR does in managing this aspect of their professional lives, which directly impacts their personal finances.

Calculation of Income Tax according to Tax Slabs and Rates

To calculate your income tax liability in India, you need to understand the income tax slabs and rates set by the government. These slabs and rates vary depending on your total income and age. There are two regimes for tax calculation – the old regime and the new, simplified regime introduced in the budget of 2020. Taxpayers can choose which regime to follow.

Income Tax Slabs and Rates

Under the old regime, there are three main slabs for individuals below 60 years:

- Income up to ₹2,50,000 – No tax

- Income from ₹2,50,001 to ₹5,00,000 – 5% tax

- Income from ₹5,00,001 to ₹10,00,000 – 20% tax

- Income above ₹10,00,000 – 30% tax

For senior citizens (aged 60 years or above but less than 80 years), the tax exemption limit is higher.

The new regime offers lower tax rates but with no exemptions or deductions. The slabs under this regime are:

- Income up to ₹2,50,000 – No tax

- Income from ₹2,50,001 to ₹5,00,000 – 5% tax

- Income from ₹5,00,001 to ₹7,50,000 – 10% tax

- Income from ₹7,50,001 to ₹10,00,000 – 15% tax

- Income from ₹10,00,001 to ₹12,50,000 – 20% tax

- Income from ₹12,50,001 to ₹15,00,000 – 25% tax

- Income above ₹15,00,000 – 30% tax

for the financial year 2023-2024, There’s also a rebate under section 87A, which provides relief to taxpayers whose total income does not exceed a certain limit (e.g., ₹5,00,000), effectively reducing their tax liability to zero.

Incremental Taxation

One common misconception is regarding how income is taxed. Many people believe that once they cross a certain income threshold, their entire income is taxed at the higher rate. However, India follows a progressive tax system, meaning you only pay the higher rate on the income that falls within that higher bracket.

For example, if your income is ₹8,00,000 under the old regime, you do not pay 20% on the entire amount. Instead, you pay:

- No tax on the first ₹2,50,000

- 5% on the next ₹2,50,000 (₹2,50,001 to ₹5,00,000)

- 20% on the remaining ₹3,00,000 (₹5,00,001 to ₹8,00,000)

Example of Tax Calculation

Let’s calculate the tax for a hypothetical individual under the old regime with an annual income of ₹8,50,000:

- Income up to ₹2,50,000: No tax

- Next ₹2,50,000 (₹2,50,001 to ₹5,00,000): 5% = ₹12,500

- Next ₹3,50,000 (₹5,00,001 to ₹8,50,000): 20% = ₹70,000

Total tax liability = ₹12,500 + ₹70,000 = ₹82,500

lets understand by another example

Suppose your total taxable income is ₹8,00,000. Here’s how your tax would be calculated:

- For the first ₹2,50,000, there’s no tax.

- For the next ₹2,50,000 (from ₹2,50,001 to ₹5,00,000), the tax is 5%, which amounts to ₹12,500.

- For the remaining ₹3,00,000 (from ₹5,00,001 to ₹8,00,000), the tax is 20%, which amounts to ₹60,000.

So, your total tax liability would be ₹12,500 + ₹60,000 = ₹72,500, not counting any deductions or exemptions you may be eligible for.

Understanding these concepts and correctly applying the tax slabs and rates to your income can help you accurately calculate your tax liability, plan your finances better, and make informed decisions about investments and expenditures.

How Taxable Income Differs from Gross Salary or Total Income

In India, understanding the concept of taxable income is crucial for effectively managing your taxes, especially if you’re just starting to navigate through the intricacies of tax laws. it’s also important to keep in mind that not all income is considered taxable. Certain deductions and exemptions are allowed under the Income Tax Act, which can reduce the total taxable income.

So, lets understand Gross salary and taxable salary.

- Gross Salary/Total Income: This is the total income earned by an individual, including all salaries, bonuses, benefits, and income from other sources before any deductions or taxes are applied.

- Taxable Income: This is the portion of the total income that is subject to taxation after subtracting allowable deductions, exemptions, and other non-taxable sources of income. It essentially represents the net amount of income that is taxed by the government.

Example: If Mr. Sharma has a gross salary of ₹10,00,000 per annum, and he invests ₹1,50,000 in PPF (Public Provident Fund) which is deductible under Section 80C, and pays ₹25,000 for health insurance deductible under Section 80D, his taxable income would be calculated as follows:

Gross Salary = ₹10,00,000 Deductions (PPF + Health Insurance) = ₹1,50,000 + ₹25,000 = ₹1,75,000 Taxable Income = Gross Salary – Deductions = ₹10,00,000 – ₹1,75,000 = ₹8,25,000

Thus, Mr. Sharma’s taxable income would be ₹8,25,000, which is lower than his gross salary.

Strategies for Reducing Taxable Income

Invest in Tax-Saving Instruments:

Individuals can invest in various tax-saving instruments such as Equity Linked Saving Schemes (ELSS), Public Provident Fund (PPF), National Pension System (NPS), National Savings Certificate (NSC), life insurance premiums and tax-saving fixed deposits to reduce their taxable income. These investments offer deductions under Section 80C of the Income Tax Act up to ₹1.5 lakh per annum.

National Pension System (NPS):

Contributions to NPS are eligible for an additional deduction up to ₹50,000 under Section 80CCD(1B), over and above the ₹1.5 lakh limit under Section 80C.

Claim Deductions for Expenses:

Certain expenses such as tuition fees for children’s education, Repayment of home loan principal, and Medical expenses for specific diseases are eligible for deductions under various sections of the Income Tax Act. By keeping track of these expenses and claiming deductions, individuals can reduce their taxable income.

Utilize Allowances and Exemptions:

Individuals can make use of allowances such as house rent allowance (HRA), leave travel allowance (LTA), and exemptions such as the standard deduction to reduce their taxable income. By structuring their salary components effectively, individuals can optimize their tax liability.

Opt for Tax-Free Income:

Certain sources of income such as dividends from equity shares, long-term capital gains from equity investments, and interest earned on tax-free bonds are exempt from tax. By diversifying their income sources and earning tax-free income, individuals can reduce their overall tax liability.

Health Insurance Premiums:

Under Section 80D, premiums paid for health insurance for yourself and your family (spouse, children) can be claimed as deductions. This is apart from the deductions under 80C and can significantly reduce your taxable income. This not only helps in lowering your tax liability but also encourages individuals to get health insurance coverage.

Education Loan Interest:

Interest paid on education loans can be claimed as a deduction under Section 80E, with no upper limit. This is beneficial for individuals paying for higher education for themselves, their spouse, children, or for a student for whom they are a legal guardian.

Charitable Contributions:

Donations made to certain registered charities can be claimed as deductions under Section 80G. The deduction can be either 50% or 100% of the amount donated, depending on the institution donated to, with or without a restriction on the deduction amount. This not only reduces your taxable income but also encourages philanthropic activities.

Home Loan Interest:

If you have a home loan, the interest paid on the loan can be claimed as a deduction under Section 24, up to ₹2 lakh per annum. This can substantially lower your taxable income if you’re a homeowner with an ongoing home loan.

Saving Account Interest: Interest earned on savings accounts up to INR 10,000 per year is tax-exempt under Section 80TTA for individuals and HUFs.

Opt for New Tax Regime with Lower Rates:

Starting from the financial year 2020-21, India introduced a new tax regime with lower tax rates but without the option of most deductions and exemptions. Depending on your investments and deductions, opting for the new regime might result in lower tax liability.

By strategically planning your investments and spending in areas that offer tax benefits, you can effectively reduce your taxable income and, consequently, your tax liability. It’s also beneficial to consult with a tax advisor to better understand these provisions and make the most of the opportunities to save on taxes.

The New Tax Regime

The Indian government introduced an alternate tax system in the 2020 Union Budget, offering lower tax rates compared to the existing (or old) tax regime. However, the catch in the new tax regime is the limitation on claiming various deductions and exemptions available under the old regime. This new system is optional, allowing taxpayers to choose between the two based on which one is more beneficial for them.

Under the new regime, the tax rates are structured as follows (for individuals and HUFs):

- Income up to ₹2.5 lakh: No tax

- Income from ₹2,50,001 to ₹5,00,000: 5%

- Income from ₹5,00,001 to ₹7,50,000: 10%

- Income from ₹7,50,001 to ₹10,00,000: 15%

- Income from ₹10,00,001 to ₹12,50,000: 20%

- Income from ₹12,50,001 to ₹15,00,000: 25%

- Income above ₹15,00,000: 30%

It’s important to note that if you opt for the new regime, you cannot claim certain deductions and exemptions such as Section 80C (investments in PPF, ELSS, etc.), housing loan interest under Section 24, and standard deduction, among others.

Impact on Personal Finance Management and Tax Planning

The introduction of the new tax regime significantly impacts personal finance management and tax planning in several ways:

- Choice Between Regimes: Taxpayers need to evaluate their financial situation, investment plans, and potential deductions and exemptions under the old regime to make an informed decision on which regime to choose. This adds an extra layer to tax planning, requiring a more detailed analysis.

- Simplified Tax Filing: For those who do not have many deductions or exemptions to claim, the new regime offers a simpler way to file taxes without the hassle of keeping track of various investments and expenses for deductions.

- Impact on Investments: Since many tax-saving investments (like ELSS, PPF, etc.) are not deductible under the new regime, individuals might rethink their investment strategies. This could lead to a shift towards more flexible investment options that do not necessarily offer tax benefits but align better with other financial goals.

- Future Financial Planning: The decision between the two regimes could also influence future financial planning, especially for long-term goals like retirement, where deductions like those under Section 80C play a significant role in reducing taxable income.

Example

Let’s consider an example to understand the practical implications:

Mr. A has an annual income of ₹10,00,000.

- Under the old regime, after claiming various deductions (such as ₹1,50,000 under Section 80C, ₹50,000 under NPS Section 80CCD(1B), and ₹25,000 under Section 80D), his taxable income reduces to ₹7,75,000.

- Calculating tax under both regimes, he finds that the old regime, with deductions, offers a lower tax liability compared to the flat rates of the new regime without those deductions.

This example highlights the importance of evaluating personal circumstances and financial goals when choosing between the tax regimes.

The new tax regime in India offers an alternative to the traditional tax system, aiming to simplify the tax filing process for many. However, the choice between the old and new regimes depends on individual financial situations and long-term goals. Effective tax planning under the new regime involves understanding the limitations on deductions and exemptions and might require a shift in investment strategies to align with financial objectives without relying on tax benefits.

Must use Strategies for Reducing Taxable Income for income tax savings

⬇️You May Also Read ⬇️

➤Understanding the New Mutual Fund NAV Rules of Cut-off Timings

➤Understanding Financial Goals and Planning: A Guide to Smart Investments

2 thoughts on “Mastering Income Tax savings: A Beginner’s Guide to Save Money Legally”