Investing in mutual funds can be a rewarding venture, but it is important to understand the potential downsides. Let us learn about the limitations and disadvantages of Mutual Funds in simple words to empower investors with the knowledge to make informed choices.

Mutual funds are a popular investment option for many people due to their convenience and diversification benefits. However, there are also some limitations and disadvantages that investors should be aware of before investing their money.

Table of Contents

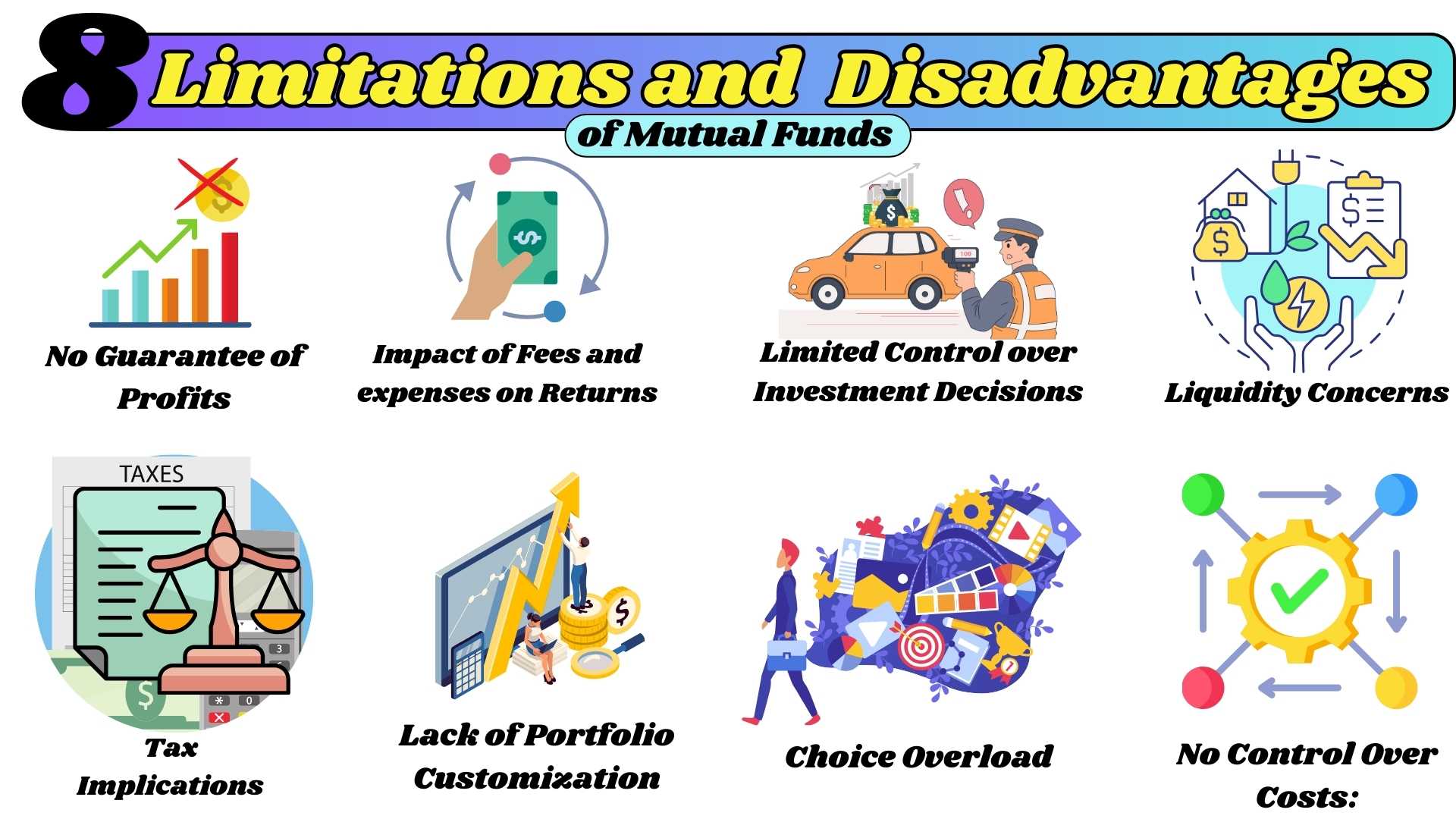

Limitations and Disadvantages of Mutual Funds

Mutual funds are an incredibly popular investment vehicle, but like any investment, they come with limitations and disadvantages. Here are some of the most commonly cited limitations and disadvantages of mutual funds:

No Guarantee of Profits

When you invest in mutual funds, it’s important to know that there’s no promise that you’ll always make a profit. Even though the Fund Manager managing the fund try their best, the value of your investments can go up and down because of changes in the market. You have to be ready for times when your investment might not make as much money, and remember that mutual funds don’t take away the natural risks that come with investing in the financial markets.

Let me explain this in simple words with examples.

Imagine you decide to put your money in a mutual fund. The fund collects money from many people and invests it in various things like stocks and bonds. The goal is to grow the money over time.

Now, here’s the thing: the value of these investments can change. Sometimes they go up, and sometimes they go down due different situation and factors of Markets. Let’s say the stock market, where a lot of these investments are, has a bad day ( Like Recession, Coronavirus Pandemic etc.). In that case, the value of your mutual fund might go down, and you could have less money than you started with.

For example, you invested ₹1,00,000/- in a mutual fund, and the value of the investments dropped. Now, your investment might be worth only ₹90,000/-. That’s a loss. Mutual funds don’t guarantee that you’ll always make a profit because the market is always changing.

So, it’s like planting seeds in a garden. You hope they grow into beautiful flowers, but there’s no guarantee. Sometimes the weather or other factors might affect how well your flowers grow. Similarly, in mutual funds, the market conditions can impact the value of your investment.

Remember, investing always involves some level of uncertainty, and mutual funds are no exception. so, It’s important to be aware that your money can go up and down, and there’s no guarantee of making a profit every time.

Impact of Fees and expenses on Returns

While the convenience of having professionals manage your investments is an attractive feature of mutual funds, it comes at a cost. Mutual funds charge fees for their services, including management fees, operating expenses, and other charges. These fees can significantly eat into your overall returns, and it’s crucial for investors to understand the fee structure and how it may affect the profitability of their investments over time.

Let me explain this in simple words with examples.

When you put your money in a mutual fund, the people managing the fund charge you for their services. These charges are like fees, and they can have an impact on the returns you get from your investment

For example, imagine you invest ₹1,00,000/- in a mutual fund, and it has a 1% annual fee. This means you pay ₹1,000 each year to the fund managers. If your investment grows by 5% in a year, you might think you’ve made ₹5,000. However, because of the 1% fee, your actual profit would be ₹4,000(₹5,000- ₹1,000). you have to subtract the ₹1,000 you paid. So, instead of making ₹5,000, you end up with ₹4,000. So, if you sell this MF then you will get ₹1,04,000/- in your bank account.

Now, imagine your friend invests the same ₹1,00,000/- but in a different mutual fund with lower fees, let’s say 0.5%. it also grew by 5%, your profit would be₹4,500(₹5,000- ₹500). In this case, only ₹500 goes to the manager, and if your friend sell this MF then he will get ₹1,04,500/- in his bank account.

Note- Both Mutual Fund scheme give 5% returns but in actual, you get 4% Return and your friend got 4.5% returns , all Because of fees and Expenses of that Mutual Funds.

so, the lower fee allows you to keep more of your returns.

In simple terms, fees take a slice of your profits. The higher the fees, the less money you get to keep. It’s like having a cookie, but someone takes a bite before you get to enjoy it. So, when choosing a mutual fund, it’s essential to pay attention to the fees and make sure they won’t eat up too much of your potential earnings.

Therefore, it is important to understand the impact of fees and expenses. Even seemingly small percentages can add up over time, impacting the money you earn from your investments. Choosing funds with low fees can be a smart move to maximize your returns.

Limited Control over Investment Decisions

When you put your money in mutual funds, you don’t get to decide directly where it goes. Instead, professional fund managers make those choices for you. This means you have limited control over how your money is invested.

For example, let’s say you really like a particular company and want to invest more in it. In a mutual fund, you can’t just decide to put more of your money into that one company. The fund manager makes those decisions based on their strategy and what they think will be the best for the fund as a whole.

So, while mutual funds offer diversification and the expertise of professionals, it’s important to know that you won’t have the same control as you would if you were picking individual investments on your own. Therefore, if you’re someone who prefers a more active role in shaping your investment strategy, mutual funds are less suitable for those seeking more autonomy.

Mutual funds can be convenient because you don’t have to make all the choices, it also means you have to trust someone else to run the scheme and make the right decisions for your money.

Liquidity Concerns

Mutual funds allow investors to buy or sell units at the net asset value (NAV) at the end of the trading day. However, there are instances where liquidity becomes a concern. If too many investors decide to sell their shares simultaneously, it can lead to challenges in quickly liquidating assets. This lack of immediate liquidity can be a drawback, particularly for those who may need fast access to their money.

Let’s break it down in simpler terms with examples

Liquidity concerns in mutual funds mean that sometimes it might not be easy to quickly turn your investments into cash, especially when many people are trying to sell their mutual fund shares at the same time.

Example 1: Imagine that you have invested money in a mutual fund, and you suddenly need that money for some unexpected expense or emergency. Again, you will not get your money immediately or on the same day, you will have to wait at least one or two working days to get the money.

Example 2: Suppose that at the same time many other people are also trying to sell their mutual fund units. Then the fund manager has to buy back these units from the investor and pay the money. For this the fund manager will have to sell his equity shares or bonds. If the amount is too large the manager will not be able to find that much buyers to sell to, so they will be short of cash to pay their investors. So in this case, there will be liquidity concerns also.

Understanding liquidity concerns is essential, as it helps investors know that in certain situations, it may not be as easy to sell mutual fund shares quickly as they expect.

Tax Implications

Gains from mutual fund investments may be subject to taxes, and the tax implications can impact the overall returns on your investment. Understanding the tax implications, including potential capital gains taxes, is crucial for accurately assessing the true after-tax returns on your investment.

Investors should factor in these tax considerations when evaluating the overall attractiveness of mutual funds in their portfolio.

let’s break down the tax part in simpler terms.

When you invest in mutual funds, you might need to pay taxes on the money you make. This can affect how much profit you actually get to keep. Understanding these tax things, especially capital gains taxes, is really important. It helps you figure out the real amount of money you’ll have after taxes.

Here’s a simple example to Understand:

Imagine you have invested ₹1,00,000 in a mutual fund, and over time it grows to ₹1,50,000. This is a profit of ₹50,000. Now, depending on tax rules, you may have to pay some of that profit in taxes. Suppose the capital gains tax is 10%. You will have to pay ₹5,000 of your profit of ₹50,000 to the government. So, instead of having the entire ₹50,000 in your pocket, you will have ₹45,000 after paying taxes.

Understanding these tax things is like knowing how much of your cookie you actually get to eat after sharing it with others. It’s somewhat the same with your investment gains – taxes take a portion, so you need to plan for it. Investors should think about these taxes when deciding whether mutual funds are a good fit for their wealth goals.

| You may like this also : |

|---|

| Mutual Fund And It’s Basic Concepts |

| 12 Advantages of Mutual Funds for Investors |

Lack of Portfolio Customization

Mutual funds follow a pre-determined investment strategy, limiting investors’ ability to customize their portfolios according to individual preferences or specific financial goals. While this structure provides diversification, it may not align with the unique investment preferences of some individuals who desire a more tailored approach.

Choice Overload

The financial market offers a plethora of mutual fund options, each with its own investment objective, risk profile, and strategy. However, the abundance of choices can be overwhelming for some investors, leading to decision paralysis. Navigating through numerous options and selecting the most suitable fund can be a daunting task, especially for those new to investing.

For example, let’s say you really like technology companies because you think they will do well in the future. If a mutual fund has a rule of investing a little bit of everything, including industries like healthcare and finance, you may not get as much technology investment as you want. This lack of choice can be a downside for those who prefer a more personalized or “made-to-order” investment strategy that suits their unique preferences and goals.

No Control Over Costs:

When you put your money in mutual funds, you don’t have much say over how much it costs to manage those funds. Costs like fees and expenses are decided by the professionals handling the investments, not by you.

For example, let’s say you invested ₹1,000 in a mutual fund. If the fund’s expense ratio is 2%, it means you will be charged ₹20 each year for managing your investments, whether the fund performs well or not. You cannot control or reduce this cost – it is determined by mutual fund managers.

The lack of control over costs may be a drawback for some investors who prefer greater transparency and influence over how much they pay to manage their investments. It’s important to be aware of these costs when choosing a mutual fund and consider whether they are in line with your overall financial goals and priorities.

Conclusion:

In conclusion, mutual funds offer diversification, professional management, and accessibility to a wide range of investors. However, understanding the limitations and drawbacks is crucial for making informed investment decisions. The absence of profit guarantees, the impact of fees on returns, limited control over investment decisions, liquidity concerns, tax implications, lack of portfolio customization, choice overload, and no control over costs are factors that investors should carefully consider.

It’s essential to align your investment choices with your financial goals, risk tolerance, and preferences. If you find the limitations of mutual funds do not align with your objectives, exploring alternative investment options may be worth considering. As with any investment decision, seeking advice from a financial advisor can provide personalized guidance tailored to your specific circumstances. By being aware of the intricacies of mutual funds, investors can navigate the financial landscape with confidence and make decisions that align with their long-term financial success.

1 thought on “8 Limitations and Disadvantages of Mutual Funds”