Investing money can sometimes feel like traversing a maze with lots of options and complicated decisions. This is where mutual funds come to the rescue! In this blog post, we will explain here all Advantages of Mutual Funds, and explain why they make investing easy and beneficial for everyone.

You can also learn Basic Concept of Mutual fund From here

Table of Contents

Lets Start,

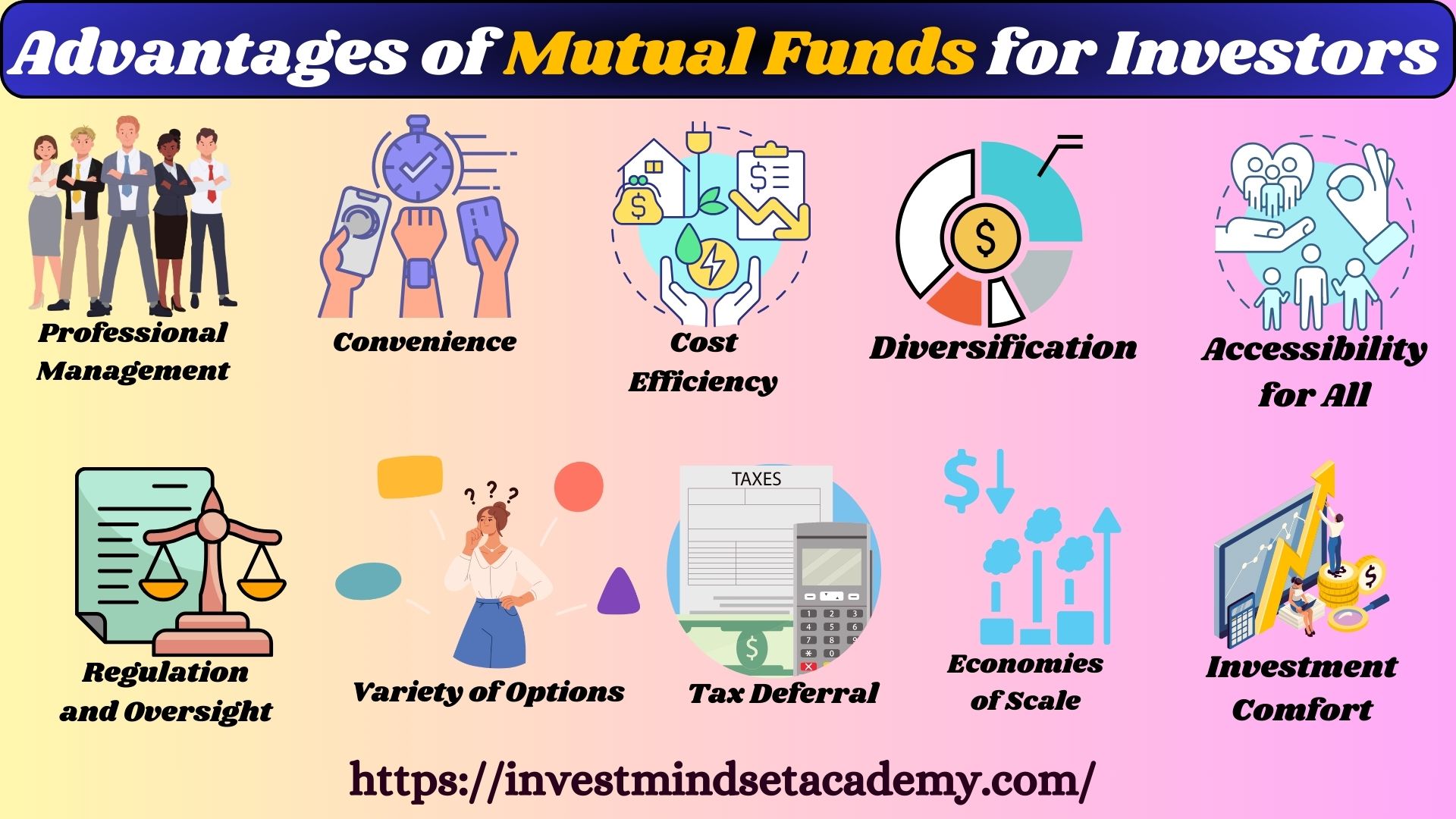

Advantages of Mutual Funds for Investors

1. Diversification: A Smart Move

What it Means: Diversification is like not putting all your eggs in one basket. It means spreading your money across different types of investments, like stocks, bonds, or real estate.

Why it Matters: If one type of investment doesn’t do well, others might perform better, reducing the overall risk. Mutual funds automatically offer this diversification, saving you from the headache of choosing individual investments.

2. Professional Management: Your Financial Captain

What it Means: Imagine having a skilled captain steering your investment ship. That’s what a mutual fund’s professional fund manager does. They make decisions on where to invest based on their expertise and market knowledge.

Why it Matters: You don’t have to become a financial expert. The fund manager takes care of the complex decisions, ensuring your money is in capable hands.

3. Accessibility for All: No High Entry Fees

What it Means: You don’t need a mountain of money to start investing in mutual funds. Even with a small amount, you can join the investing game.

Why it Matters: It makes investing more inclusive. Whether you’re a student or a seasoned professional, you can participate without needing a significant upfront sum.

4. Liquidity: Turning Investments into Cash

What it Means: Liquidity is the ease with which you can convert your investments into cash. Mutual funds usually allow you to buy and sell your units easily.

Why it Matters: You have the flexibility to access your money when needed. It’s not like investing in a house, where selling might take a long time.

5. Convenience: Let the Pros Handle It

What it Means: Managing investments can be time-consuming and confusing. With mutual funds, professionals handle the buying, selling, and monitoring of investments.

Why it Matters: You can focus on your life while experts manage your money. It’s like having a personal chef who takes care of the cooking, leaving you free to enjoy the meal.

6. Cost Efficiency: Pooling for Savings

What it Means: When many investors come together in a mutual fund, the costs of managing the investments are shared. This is cost efficiency due to economies of scale.

Why it Matters: It keeps your costs lower compared to managing individual investments. More savings for you!

7. Regulation and Oversight: A Safety Net

What it Means: Mutual funds are regulated by authorities, ensuring they follow rules and practices that protect investors.

Why it Matters: You can trust that your money is being managed within established guidelines. It adds a layer of security to your investments.

8. Variety of Options: Tailoring to Your Goals

What it Means: There are different types of mutual funds, each with specific goals. Whether you’re looking for regular income, long-term growth, or a mix of both, there’s likely a mutual fund to suit your needs.

Why it Matters: You can choose a fund aligned with your financial goals and risk tolerance. It’s like customizing your order for the perfect fit.

9. Tax Deferral: Keep More of Your Earnings

What it Means: Certain mutual funds, like retirement funds and ELSS, provide tax advantages by allowing you to defer taxes on investment gains until you withdraw the money.

Why it Matters: You can potentially lower your current tax liability, allowing your investments to grow more efficiently.

10. Economies of Scale: Saving More with a Bigger Team

What it Means: Pooling money with many investors allows mutual funds to benefit from economies of scale, reducing transaction costs and fees.

Why it Matters: Your overall costs are lower because they are shared among a larger group. It’s like getting a discount for being part of a big shopping group.

11. Investment Comfort: Stress-Free Investing

What it Means: Investing can be intimidating, especially for beginners. Mutual funds offer a comfortable entry point as professionals manage the complexities.

Why it Matters: You can invest with confidence, knowing experienced hands are guiding your money. It’s like having a financial safety net.

12. Systematic Approach to Investment: Consistency is Key

What it Means: Systematic Investment Plans (SIPs) allow you to invest a fixed amount regularly, fostering a disciplined approach to wealth creation.

Why it Matters: Consistent investing over time can lead to significant returns. It’s like building a savings habit without feeling the burden.

Conclusion: Simplifying Investing for All

Mutual funds offer a range of benefits that simplify the investing journey. Whether you’re a beginner or an experienced investor, the advantages of diversification, professional management, accessibility, liquidity, convenience, cost efficiency, regulation, variety, tax deferral, economies of scale, investment comfort, and a systematic approach make mutual funds an attractive and accessible option for growing your wealth.

In our next post, we’ll delve into the potential downsides or limitations of mutual funds, ensuring you have a comprehensive understanding before taking the investment plunge. Stay tuned for more insights!

You May Read Following Posts:

- 5 Simple Budgeting Tips to Save More Money Every Month

- 6 Ways to Attract Money: A Comprehensive Guide

- Vande Bharat Trains Manufacturing Company list- Evolution and Expansion of Vande Bharat Trains

- Rail Vikas Nigam Ltd: Fundamentals Analysis and Updates

- The 3 Pillars of Wealth: Mindset, Habits, and Money