If you have ever invested in mutual funds or are considering doing so, you must have encountered terms like NAV (Net Asset Value), sale price and repurchase price. In a letter dated 22 July 2002, the Chief General Manager of the Mutual Funds Department addressed concerns regarding the varied methods used by mutual funds to calculate these prices. The goal of this letter of SEBI was to establish uniformity in the industry, making it easier for investors to understand the calculations.

You can Read official letter to Calculate NAV from here – https://www.sebi.gov.in/sebi_data/commondocs/cirmfd082002_h.html

In this blog, we will explain each terms and break down the main points mentioned in the letter, focus on the calculation of NAV (Net Asset Value), sale price & repurchase price and provide examples for better clarity.

Calculation of NAV, Sale and Repurchase Price in Mutual Funds

Table of Contents

Understanding Calculation of NAV

What is NAV in Mutual Funds?

Net Asset Value (NAV) is a key concept in the world of mutual funds. It represents the per-unit market value of all the securities (such as stocks, bonds, and other financial instruments) held in a mutual fund’s portfolio, minus any liabilities. Real value of a unit of MF Scheme is also known as the Net Asset Value (NAV) of the scheme.

In simpler terms, NAV is the price at which investors buy or sell units of a mutual fund.

The NAV per unit is calculated regularly, typically at the end of each business day, and it reflects the current value of each unit of the mutual fund. Investors use NAV as an indicator of the fund’s performance and to assess the value of their investments.

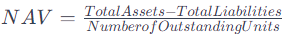

The formula to calculate NAV is:

Here’s a breakdown of the key components:

- Total Assets: This includes all the securities, cash, and other assets held by the mutual fund.

- Total Liabilities: These are the fund’s obligations or debts, such as outstanding expenses or payments.

- Number of Outstanding Units: This represents the total units of the mutual fund that have been issued and are held by investors.

Important to note

- NAV alone doesn’t determine the profitability or attractiveness of a mutual fund. The performance of a mutual fund should be evaluated over time, considering factors such as returns, risk, expense ratios, and the fund manager’s strategy.

- NAV in mutual funds is a fundamental metric that provides investors with the current market value of each unit in the fund, helping them assess the overall health and performance of their investment.

Let us clarify the secret of this formula with some examples.

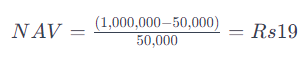

Example 1:

Suppose a mutual fund has total assets worth Rs 1,000,000 and total liabilities of Rs 50,000. If there are 50,000 outstanding units, the NAV would be:

This means that each unit of the mutual fund is currently valued at Rs 19.

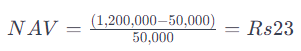

Example 2:

Let’s consider another scenario. If the total assets increase to Rs 1,200,000 and the liabilities remain the same at Rs 50,000, with the same 50,000 outstanding units, the new NAV would be:

Here, the increase in total assets leads to a higher NAV, indicating a potentially positive performance for the mutual fund.

Understanding the Net Asset Value (NAV) of a mutual fund is crucial for investors, and there are several important Points to keep in mind:

- Daily Calculation: NAV is typically calculated daily, at the end of each business day. This ensures that investors have access to the most up-to-date valuation of their investments.

- Market Fluctuations: NAV is sensitive to market fluctuations. Changes in the value of the underlying securities held by the mutual fund will directly impact the NAV. Therefore, it’s common for NAV to vary from one day to the next.

- Buying and Selling Price: While NAV represents the per-unit value of a mutual fund, investors should be aware that when buying or selling mutual fund units, they transact at the fund’s next calculated NAV. The buying price may include additional charges like a sales load, while the selling price may have an exit load or redemption fee.

- Performance Indicator: While a higher NAV may indicate better performance, it’s essential to consider the fund’s historical performance, investment strategy, risk profile, and the overall market conditions. Comparing the NAV of a fund with its historical NAV or benchmark indices provides a more comprehensive performance assessment.

- Not an Indicator of Profitability: The NAV itself does not determine the profitability of an investment. It merely reflects the current value of the fund’s assets per unit. Profitability is better assessed by analyzing the fund’s total returns, which account for changes in NAV and any distributions made by the fund.

- Expense Ratios Impact NAV: Mutual funds incur operating expenses, which are deducted from the fund’s assets. These expenses include management fees, administrative costs, and other operational charges. The NAV is calculated after deducting these expenses, so a lower expense ratio can contribute to a higher NAV.

- Dividends and Distributions: If a mutual fund pays dividends or makes capital gains distributions, the NAV will be adjusted downward to account for these payouts. Investors should be aware of the impact of distributions on the NAV and their overall returns.

- Reinvestment of Earnings: In mutual funds that offer dividend reinvestment plans (DRIPs), dividends and capital gains distributions can be automatically reinvested in additional fund units, potentially increasing the number of units held by investors.

- Use in Performance Measurement: While NAV is an important metric, investors should use it in conjunction with other performance indicators such as total returns, risk-adjusted returns, and benchmark comparisons to make well-informed investment decisions.

- Transparency: Mutual funds are required to disclose their NAV, expense ratios, and other relevant information regularly. Investors should review this information in fund reports and prospectuses to stay informed about their investments.

Understanding Calculation of Sale and Repurchase Price

Regulation 49(3) of the SEBI (Mutual Funds) Regulations, 1996, outlines the parameters for calculating the sale and repurchase prices of mutual fund units for investors. However, there has been inconsistency in the methods adopted by different mutual funds. While some use one formula for both sale and repurchase prices, others resort to different formulas for each, leading to slight variations in the amount payable to investors and potential confusion.

After extensive discussions with stakeholders in the mutual funds industry, a consensus has been reached. The directive mandates a uniform method to be adopted by all mutual funds for calculating sale and repurchase prices. The focus is on clarity and simplicity, ensuring investors can easily comprehend the processes involved.

The Unified Formula:

The instructions state in the letter published is that the load (fee) will be expressed as a percentage of the net asset value (NAV) and It must be clarified in the offer documents i.e. applicable load as a percentage of NAV will be added to NAV to calculate sale price and will be subtracted from NAV to calculate repurchase price.

The formulas are summarized as follows:

- Sale Price = Applicable NAV * (1 + Sales Load, if any)

- Repurchase Price = Applicable NAV * (1 – Exit Load, if any)

Example:

Suppose the applicable NAV is Rs 100, the sales load is 1%, and the exit load is 1%. Using the provided formulas:

- Sale Price = 100×(1+0.01)=Rs 101

- Re-purchase Price=100×(1−0.01)=Rs 99

This means that if you were to buy the mutual fund, you would pay Rs 101 per unit (including the 1% sales load), and if you were to sell it, you would receive Rs 99 per unit (after deducting the 1% exit load).

Rounding Off NAVs:

In addition to standardizing the calculation methods, it is recommended, in alignment with the Association of Mutual Funds in India, to round off NAVs to four decimal places in liquid/money market mutual fund schemes and up to two decimal places in other schemes.

This step aims to bring about uniformity in the industry and should also be explicitly mentioned in the offer documents.

Applicability and Implementation:

These guidelines, effective from August 5, 2002, are applicable to all existing and new schemes. Mutual funds are directed to incorporate these changes in their new offer documents and update existing ones in accordance with SEBI guidelines.

Conclusion:

Chief General Manager P.K. Nagpal’s letter underscores the commitment to enhancing transparency and consistency in the mutual funds industry. By implementing a standardized approach to calculate sale and repurchase prices, and rounding off NAVs, the directive seeks to simplify processes and eliminate confusion for investors. These guidelines not only align with SEBI regulations but also demonstrate a collective effort to foster trust and understanding within the mutual funds landscape. As investors navigate the complexities of financial markets, these measures aim to provide a clearer path for making informed investment decisions.

3 thoughts on “Understanding Calculation of NAV, Sale and Repurchase Price in Mutual Funds: A Simple Guide”