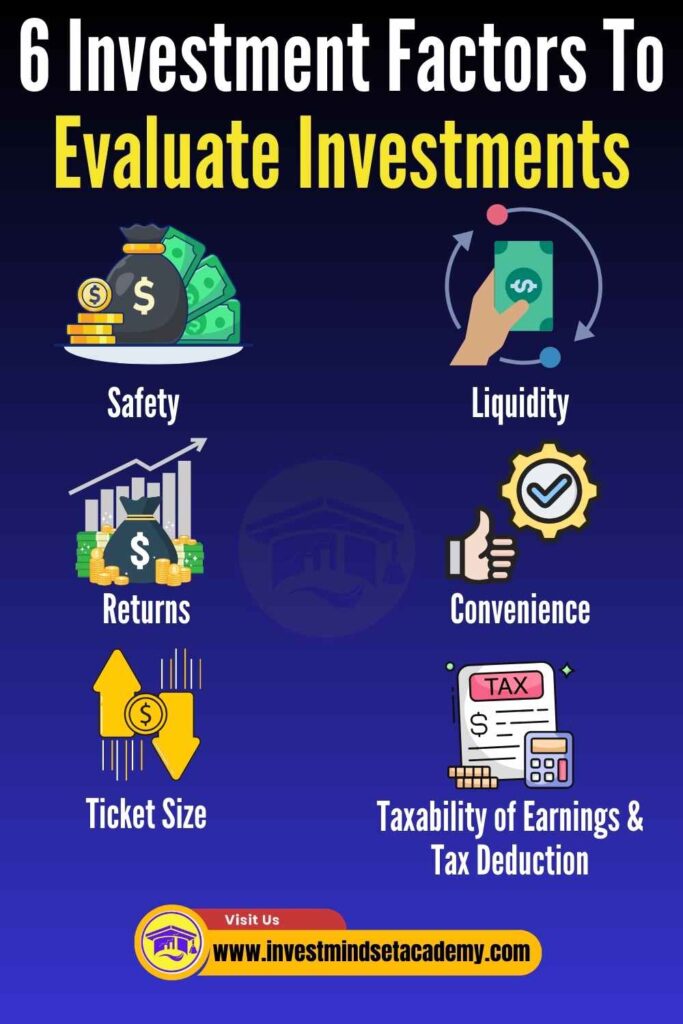

When it comes to investing your hard-earned money, there are three key things you should always keep in mind: safety, liquidity, and returns. These factors help you understand how secure your investment is, how easily you can turn it into cash, and how much money you could potentially make from it. But that’s not all. Other important aspects like convenience, the minimum amount needed to start investing (also known as ticket size), how your earnings are taxed, and whether you can get a tax deduction also play a significant role. Let’s dive deeper into these Investment Factors and see how they can influence your investment decisions.

Investment Factors to evaluate investments

6 Investment Factors are Followings:

- Safety

- Liquidity

- Returns

- Convenience

- Ticket Size

- Taxability of Earnings & Tax Deduction

Read whole post to understand each factors before any financial investment decisions

You may Read – An In-Depth Guide to Mutual Fund Returns: Calculation Techniques, Insights and Tips

Safety: Understanding Investment Safety

Investment safety is all about making sure the money you put into an investment comes back to you without taking a hit. Imagine lending your favorite toy to a friend; you’d want to make sure it comes back to you in the same condition, right? That’s how investment safety works. It’s not just about getting your original amount back, but also about being able to predict how much extra money (or income) you’ll make from it. The more certain you are that you won’t lose money and will earn a steady income, the safer your investment is considered to be.

Types of Risks

When you invest, you’re basically putting your money on a journey, and like any journey, there could be bumps along the way. Here are some risks that could affect your investment’s safety:

- Market Risk: This is when the overall market takes a dive, and your investment goes down with it. It’s like if all toys suddenly became less popular, and your friend doesn’t value your toy as much.

- Credit Risk: Imagine you lend money to a friend to start a lemonade stand. If your friend’s business fails and they can’t pay you back, that’s credit risk.

- Interest Rate Risk: This happens when interest rates go up or down in a way that affects your investment. If you’ve lent someone money and interest rates go up, but you’re stuck with the lower rate you agreed on, you’re facing interest rate risk.

- Liquidity Risk: This is about how quickly you can turn your investment back into cash without losing value. If you needed your toy back immediately but your friend couldn’t return it right away, that’s similar to liquidity risk.

- Inflation Risk: This is the risk that the return on your investment might not keep up with the rate of inflation, which means your investment’s purchasing power could decrease over time. Imagine you invest in a fixed deposit that earns 2% a year, but inflation is 3% a year. Though you’re earning money, the value of that money is actually going down.

Assessing Investment Safety

To figure out how safe an investment is, you can use a few strategies:

- Research: Learn as much as you can about the investment. Look into the company’s history, its financial health, and its future prospects if you’re thinking about buying shares. For bonds, check the credit rating of the issuer to see how likely they are to pay you back.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across different types, like stocks, bonds, and real estate. This way, if one investment goes bad, you won’t lose everything.

- Understand Your Tolerance for Risk: Know how much risk you’re comfortable taking. If the idea of losing money keeps you up at night, safer investments like government bonds or savings accounts might be better for you, even if they offer lower returns.

- Consult Financial Advisors: Sometimes, it’s a good idea to talk to a professional. Financial advisors can help you assess the risks and make choices that fit your goals and risk tolerance.

- Consider Time Horizon: The longer you can leave your money invested, the more likely you are to weather any storms that come. If you need your money back soon, you might want to choose safer, more liquid investments.

- Check Ratings: For bonds, look at credit ratings given by agencies like Moody’s or Standard & Poor’s, which tell you how likely it is that the bond issuer will pay you back. It’s like checking the weather forecast before sailing.

Remember, every investment comes with some risk, but by doing your homework and using these strategies, you can make smarter choices about where to put your money.

Examples

- A savings account is considered a very safe investment because it has low risk of losing money and offers predictable interest income. However, the return might be lower compared to riskier investments.

- Stocks can offer higher returns, but they come with higher market risk. If the company does well, you could make a lot of money. If it doesn’t, you might lose your investment.

Remember, finding the right balance between safety and potential returns is key to making smart investment choices.

Liquidity in Investments

Liquidity in investments refers to how quickly and easily you can convert your investments into cash without losing a significant amount of value. Essentially, it’s about how easily you can get your money back when you need it. Imagine you have a toy that everyone wants to buy; you can quickly sell it for a good price. In the world of investments, being able to turn your investment into cash quickly is very necessary factor to consider before investment.

Importance of Liquidity

Liquidity is super important because life is full of surprises. You might suddenly need cash for an emergency, like fixing a broken car or paying for a hospital visit. If your investments are liquid, you can get the cash you need quickly without a hassle. It’s like having a safety net that ensures you can access your money whenever you need it.

Why is Liquidity Important?

- Emergency Funds: If you suddenly need money for an unexpected expense, liquid investments can be a lifesaver, allowing you to cover the cost without resorting to loans or credit cards.

- Investment Opportunities: Sometimes, an opportunity may arise, and having liquid assets means you can take advantage of it without delay.

- Peace of Mind: Knowing that you can easily access your investments without significant loss gives you a sense of security.

Factors Affecting Liquidity

- Product Nature: Some investments are naturally more liquid than others. Stocks are a good example of a liquid investment because they can be sold quickly on the stock market. Real estate, on the other hand, is considered less liquid because it can take a long time to find a buyer and complete the sale.

- Operational Features: Some investments come with conditions like lock-in periods, during which you cannot sell the investment. For example, certain types of bank accounts or government bonds might not allow you to withdraw your money for a set period without facing a penalty.

- Penalties for Early Exit: Some investments might allow you to exit early but will charge you a fee for doing so. This fee reduces the overall amount you get back, making the investment less liquid. A common example is the penalty for early withdrawal from a Certificate of Deposit (CD) before its maturity date.

- Divisibility: This refers to whether you can sell part of your investment. Stocks are divisible because you can sell just a few shares if you need a small amount of cash, making them very liquid. Real estate, on the other hand, is not divisible; you can’t sell just a part of your house easily.

Examples to Understand Liquidity

- Stocks: Highly liquid because they can be sold on the stock market almost instantly during trading hours.

- Real Estate: Less liquid because it can take weeks, months, or even longer to find a buyer and complete the sale.

- Savings Account: Very liquid because you can withdraw your money anytime without penalties.

- Certificate of Deposit (CD): Less liquid because withdrawing money before the maturity date usually incurs a penalty.

Examples of Liquid and Illiquid Investments

- Liquid: Savings accounts, stocks, and government bonds are considered liquid because they can be quickly converted into cash, usually without a significant loss in value.

- Illiquid: Real estate, art, and specialized business investments are examples of illiquid assets. While they might offer substantial returns over time, converting them into cash quickly can be challenging and might require selling at a discount.

Returns in Investments

Returns on investments are essentially the money you make from putting your cash into something, like stocks, bonds, or real estate. Think of it as a reward for risking your money.

What are Returns?

When you invest money, you’re hoping to get more money back in the future. This extra money you earn from your investment is what we call “Returns.” There are two main types of returns: current income and capital gains.

- Current Income: This is money you receive regularly from your investment. For example, if you own shares in a company that pays dividends, those dividends are your current income. It’s like getting a small paycheck for owning part of the company.

- Capital Gains: This happens when the value of your investment goes up over time. Let’s say you buy a piece of art for Rs10,000, and five years later, it’s worth Rs15,000. If you sell it at that higher price, the extra Rs5,000 you made is your capital gain. You didn’t get regular payments from the art, but its value increased.

However, making money from investments isn’t always straightforward. Sometimes, when you decide to pull your money out, you might have to pay exit charges or penalties. These are like fees for saying “I want my money back now.” For example, some investment funds charge you a small percentage of your investment if you decide to take your money out before a certain period. This can eat into your returns because it’s money you’re paying just to access your own investment.

That’s why it’s essential to consider liquidity (how quickly and easily you can convert your investment into cash) and safety (how risky your investment is) alongside the potential returns. A high-return investment might seem attractive, but if it comes with high fees for early withdrawal (low liquidity) or a high chance of losing your money (low safety), it might not be as good as it initially seems.

Therefore, when the prospect of earning money from investments is exciting, it’s crucial to look at the whole picture, including any fees or risks that could reduce your overall returns. Think of it like buying a slice of cake. The slice might look big and delicious (high returns), but if the cake is expensive (high fees) or has the chance to make you sick (high risk), you might end up wishing you had chosen a different dessert.

when you’re considering an investment, think about how much money it could bring you both regularly (current income) and when you sell it (capital gains), but also keep in mind any costs for getting out early (exit charges) and how these factors balance with how quickly you can access your money (liquidity) and how safe your investment is (safety).

Additional Factors Influencing Investment Decisions

Convenience:

This factor is all about how easy it is for you to invest, access your funds, and keep track of how well your investments are doing. Imagine you want to invest some money, but the process is complicated and time-consuming. It might involve lots of paperwork or confusing steps. That’s not very convenient, right? On the other hand, if you can easily invest online with just a few clicks, check your investment performance anytime on your phone, and withdraw your money whenever you need it without hassle, that’s convenient. Convenience matters because it saves you time and makes managing your investments simpler.

Convenience in investing is all about how easy it is for you to manage your investments. This includes things like how simple it is to put money into an investment, take it out when you need it, and keep track of how your investments are doing over time.

- Ease of Investing: This refers to how straightforward it is for you to start investing your money. For example, if you can easily set up an account online and start investing with just a few clicks, that’s considered convenient. If you have to go through a long and complicated process, it’s less convenient.

- Ease of Withdrawing: This is about how easy it is to get your money back out of your investments when you need it. For instance, if you can quickly sell your stocks or withdraw cash from your savings account without any hassle, that’s convenient. If there are lots of restrictions or it takes a long time to get your money, it’s less convenient.

- Monitoring: Monitoring your investments means keeping an eye on how they’re performing over time. If you can easily check the value of your investments and see how they’re doing compared to your goals, that’s convenient. If it’s difficult to get updates on your investments or you have to jump through hoops to see how they’re doing, it’s less convenient.

Importance of Accessibility: Being able to access information about your investments and receive any income they generate is crucial. For example, if you can quickly check the value of your stocks on your phone or receive dividends directly into your bank account, that makes managing your investments much easier.

Overall, convenience in investing is essential because it makes it easier for you to manage your money and stay on top of your financial goals. When choosing investments, it’s important to consider how convenient they are to manage, as this can impact your overall satisfaction and success as an investor.

Ticket Size:

This refers to the minimum amount of money you need to invest in a particular option. For example, let’s say there’s a mutual fund with a minimum investment requirement of Rs500. That’s the ticket size. It’s essential to consider because you need to make sure you can afford the minimum investment without stretching your finances too thin. However, just because you can afford the minimum doesn’t mean it’s the best investment for you. It’s crucial to look at other factors like potential returns and risk too.

Why is Ticket Size Important?

Knowing the ticket size is essential for several reasons:

- Accessibility: It helps you understand which investments are within your budget. If you have a smaller amount of money ready to invest, you’ll need to find options with a smaller ticket size.

- Diversification: It can influence how well you can spread your investments. A lower ticket size means you can invest in multiple options, reducing the risk if one investment doesn’t perform well.

- Planning: It assists in financial planning. Knowing the minimum investment requirements helps you set savings goals if you’re eyeing a particular investment.

Examples of Ticket Size in Different Investments

- Savings Account: Virtually no minimum investment. You can start with just a few dollars, making it accessible to almost everyone.

- Stocks: Can vary significantly. Some stocks might be priced at hundreds of dollars per share, while others are just a few dollars. You can invest in cheaper stocks with a smaller amount of money.

- Real Estate: Usually has a high ticket size. Buying property requires thousands or even millions of dollars, making it less accessible for the average investor.

- Mutual Funds: Some mutual funds have minimum investment requirements of as low as Rs500 or Rs100, making them more accessible than real estate but still out of reach for some.

Caution Against Focusing Solely on Ticket Size

While ticket size is an important factor to consider, it shouldn’t be the only thing guiding your investment decisions. Here’s why:

- Risk and Return: A lower ticket size doesn’t necessarily mean lower risk or higher returns. You need to evaluate the potential risks and returns of each investment option.

- Investment Goals: Your investment decisions should align with your financial goals, time horizon, and risk tolerance, not just how much money you currently have.

- Costs and Fees: Some investments with low minimum requirements may come with high fees or costs, eating into your returns.

- Diversification: Putting all your money into investments with low ticket sizes may limit your ability to diversify your portfolio, which is important for managing risk.

- Long-Term Goals: Your investment strategy should align with your long-term financial goals. While a low ticket size investment might seem attractive in the short term, it may not contribute significantly to your financial objectives over time.

So, while the ticket size is a crucial factor in choosing where to invest, it’s important to look at the bigger picture. Consider your financial goals, the risks involved, and other costs before making a decision. This balanced approach will help you make smarter investment choices that are right for you.

Taxability of Earnings:

Understanding how taxes affect your investments is like knowing the weather before you plan a picnic. Just as bad weather can ruin your outdoor plans, not considering taxes can impact the money you make from your investments.

When you make money from your investments, you often have to pay taxes on those earnings. Different types of investments are taxed differently, and this can impact how much money you actually get to keep. For instance, if you earn interest on a savings account, that interest is usually taxed as regular income. But if you invest in stocks and hold them for a certain period, you might pay lower taxes on your earnings. Understanding how taxation affects your investment earnings helps you make smarter decisions and maximize your profits.

Taxability of Investment Earnings

Firstly, when you invest in something like stocks, bonds, or a savings account, and you make money from it, this profit is what we call “investment earnings.” Now, the government usually wants a piece of your pie – this is where taxes come into play. For example, if you invest in stocks and sell them at a higher price, the profit you make might be taxed. The same goes for the interest you earn from a savings account.

Importance of Evaluating Taxation

It’s crucial to consider how much of your earnings will go to taxes because it affects how much money you actually get to keep. Let’s say you have two investment options: one offers a 5% return but is heavily taxed, and the other offers a 4% return but with minimal taxes. At first glance, the 5% return might seem better, but after taxes, you might end up with more money from the 4% option. That’s why understanding taxation is key.

Tax Deduction:

Tax deductions are like little bonuses that can reduce the amount of tax you owe. Some investments offer tax deductions as incentives. For example, contributing to a retirement account like a 401(k) or an IRA often comes with tax deductions. This means you can lower your taxable income by investing in these accounts, which ultimately leaves you with more money in your pocket. However, it’s essential to know the rules and conditions for claiming these deductions because they may vary depending on the type of investment and your individual circumstances.

Considering these additional factors alongside safety, liquidity, and returns can help you make well-rounded investment decisions that align with your financial goals and preferences.

Now, it’s not just about understanding these factors individually. It’s also important to approach investment decisions thoughtfully and consider them holistically.

Investors should carefully weigh the safety, liquidity, and potential returns of each investment option before making a decision. They should also consider other factors such as convenience, tax implications, and their own financial goals and circumstances.

For example, if someone is planning for retirement in the next 20 years, they might prioritize investments with higher potential returns, even if they come with some level of risk. However, if someone is saving up for a down payment on a house in the next few years, they might prioritize safety and liquidity over potential returns.

Ultimately, it’s crucial for investors to align their investment choices with their individual financial goals and circumstances. This means considering factors like their age, risk tolerance, time horizon, and financial obligations.

By taking a thoughtful and holistic approach to investment decisions, investors can make choices that are more likely to help them achieve their long-term financial goals while minimizing unnecessary risks.

⬇️You May Also Read ⬇️

➤Your Secret Weapon for Tax Savings: House Rent Allowance (HRA) and Other allowances

➤Magic of the 8-4-3 Rule in Mutual Fund Investing

➤Mastering Income Tax savings: A Beginner’s Guide to Save Money Legally

➤Top 10 Powerful Reasons to Invest in Mutual Funds

➤Mastering Your Finances: The Ultimate Guide to Saving and Investing Smartly

What does investment safety mean?

Investment safety ensures that your capital returns to you without loss, similar to lending a toy and getting it back unharmed. It’s about the certainty of not losing money and earning a predictable income from your investment.

What are the main risks affecting investment safety?

Key risks include market risk (overall market downturns), credit risk (borrower’s failure to repay), interest rate risk (changes in interest rates affecting your investment), liquidity risk (difficulty in quickly converting to cash), and inflation risk (investment’s return not keeping up with inflation).

Why is liquidity important in investments?

Liquidity refers to how easily investments can be converted into cash. It’s crucial for meeting emergency needs or capitalizing on new investment opportunities without significant loss.

How does ticket size affect my investment choices?

Ticket size is the minimum amount required to invest. It determines which investments are accessible based on your budget and helps in planning and diversifying your portfolio.

How can I assess the safety of an investment?

Assessing safety involves researching the investment, diversifying your portfolio, understanding your risk tolerance, consulting financial advisors, considering your time horizon, and checking credit ratings for bonds.

What factors affect the liquidity of an investment?

Liquidity is influenced by the nature of the product, operational features like lock-in periods, penalties for early exit, and the divisibility of the investment.

What are returns in investments, and why do they matter?

Returns are the earnings from your investment, including current income (like dividends) and capital gains (increase in value). They are important as they indicate the profitability of your investment.

How do convenience factors impact investment decisions?

Convenience involves ease of investing, withdrawing funds, monitoring investment performance, and accessing information. It saves time and simplifies managing investments, affecting overall satisfaction and success.

How does the taxability of earnings and tax deductions influence investments?

Taxes can significantly impact the net returns of your investment. Understanding how investments are taxed and available tax deductions can help maximize profits and make smarter investment choices.

What are the three key factors to consider before investing?

Before investing, consider safety (risk of losing your investment), liquidity (ease of converting investments into cash), and returns (the amount of money you could make from your investment).

How does investment safety work?

Investment safety ensures that your money returns to you without loss, similar to lending a toy and getting it back unharmed. It’s about the certainty of not losing money and earning a steady income.

How should I approach investment decisions holistically?

Consider safety, liquidity, and returns, along with convenience, ticket size, tax implications, and personal financial goals. Align investment choices with your financial objectives, risk tolerance, and time horizon for a balanced approach.

1 thought on “6 Essential Investment Factors Every Beginner Should Know to evaluate investments”