Have you ever wondered how money grows over time? Well, there’s a cool trick called the 8-4-3 rule that shows us just that! It’s like planting a small seed and watching it turn into a big tree over the years. In the first 8 years, things start off slow and steady, then in the next 4 years, they speed up a bit, and finally, in the last 3 years, they really take off!

It’s all about putting your money into something called mutual funds or Stock market and letting it grow. But don’t worry if you’re not sure what mutual funds are or how they work – I’ll explain everything in detail with some examples to help you understand better. So, get ready to learn how to make your money work for you and grow bigger and stronger over time!

lets Start,

Table of Contents

What is Mutual Fund Investing

Mutual fund investing is a way for people to pool their money together to invest in a wide range of assets like stocks, bonds, or other securities. This pooling approach allows investors to diversify their investments more easily than if they were trying to buy individual stocks or bonds on their own. Mutual funds are managed by professionals who decide how to allocate the fund’s money to achieve its investment goals.

Now, let’s talk about the magic of the 8-4-3 rule in mutual fund investing, which is all about the power of compounding wealth over time. The 8-4-3 rule isn’t a widely known term in finance but serves here as a simplified principle to illustrate how regular, long-term investments can grow due to the compounding effect.

Read More – Mutual Fund Investing

But before that , lets First understand Compounding

Understanding Compounding

The concept of compounding plays a pivotal role in the world of investing, particularly in the context of mutual fund investments. Compounding, often described as the process where earnings from an investment earn additional earnings over time, is a powerful force in the growth of investments. This principle is the backbone of the 8-4-3 rule in mutual fund or Stock Market investing, illustrating the transformative power of compounding on wealth accumulation over time.

Explanation of Compounding and Its Importance in Investment

Compounding in investment refers to the ability of an asset to generate earnings, which are then reinvested or allowed to remain invested, thus generating their own earnings. Compounding allows investors to earn returns not only on the principal amount invested but also on the accumulated returns over previous periods.

The importance of compounding lies in its potential to exponentially increase the value of an investment over time. It essentially means that the longer you leave your money invested, the more significant the potential for growth, due to the earnings on the earnings. This makes compounding a crucial element for long-term financial goals, such as retirement planning, saving for a child’s education, or building a substantial investment corpus.

How Compounding Works Over Time to Grow Investments

To understand how compounding works, let’s consider an example involving a mutual fund investment. Assume you invest INR 1,00,000 in a mutual fund that delivers an average annual return of 12% (a realistic figure considering India’s mutual fund market performance over the long term).

- After 1 year, your investment grows to INR 1,12,000 (1,00,000 + (1,00,000 * 12%)).

- After 2 years, compounding kicks in. Your investment grows to INR 1,25,440 (1,12,000 + (1,12,000 * 12%)). The extra INR 13,440 earned in the second year includes returns on the returns from the first year.

- Continuing this process illustrates how compounding accelerates the growth of your investment over time.

The 8-4-3 Rule

The 8-4-3 rule is a simple yet powerful framework that illustrates the impact of compounding over different time horizons in mutual fund investing. Let’s break down the rule into its three components:

1. First 8 Years: Building the Foundation

During the first 8 years, the focus is on building the foundation of your investment through consistent contributions and allowing compounding to work its magic. This period represents the initial phase where the growth might seem gradual, but it lays the groundwork for more significant growth in the subsequent years.

2. Next 4 Years: Accelerating Growth

After the initial 8 years, the compounding effect starts to accelerate. The returns generated on your investment start to compound at a faster rate, leading to more substantial growth in a shorter period. This phase demonstrates the increasing momentum of compounding as your investment portfolio expands.

3. Final 3 Years: Super-Exponential Growth

In the final 3 years, the growth becomes super-exponential, meaning that the rate of growth increases exponentially. This phase showcases the extraordinary power of compounding as your investment reaches its peak growth potential. The compounding effect becomes so pronounced that your investment experiences rapid growth, often surpassing expectations.

Real-Life Example Illustrating the Rule’s Impact

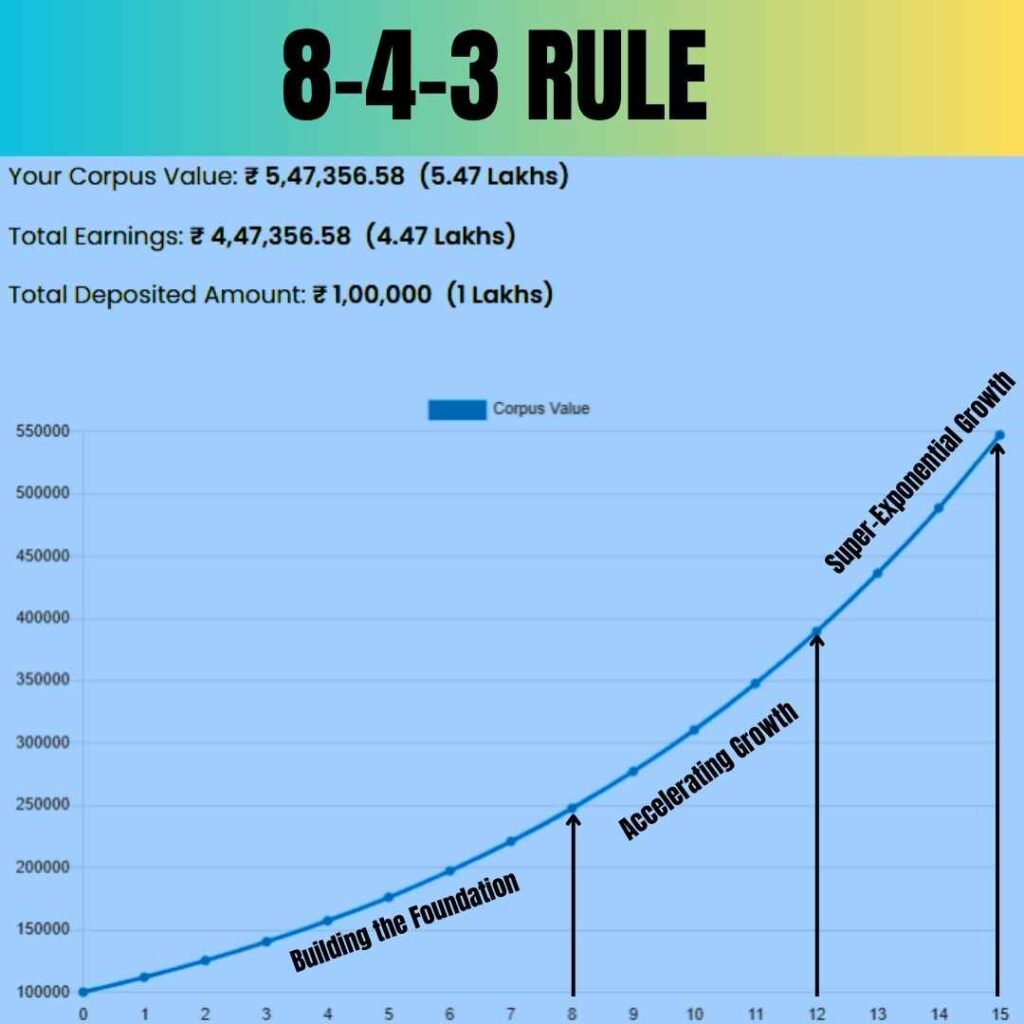

Let’s consider the real-life case of Ms. Sharma, who started investing in a mutual fund scheme with an average annual return of 12%. She initially invested INR 1,00,000.

- After 8 years, her investment doubled, reaching around INR 2,47,596.

- In the next 4 years, her investment saw accelerated growth due to the compounding effect, reaching INR 3,89,598.

- By the end of 15 years, her investment showcased super-exponential growth, with the total amount reaching approximately INR 5,47,357.

This example clearly shows how Ms. Sharma’s initial investment grew over time, thanks to the disciplined approach of staying invested and allowing her returns to compound. It underscores the essence of the 8-4-3 rule: investing with a long-term horizon can lead to significant wealth accumulation, demonstrating the magic of compounding. This rule emphasizes the importance of patience, consistency, and the strategic use of time in the realm of mutual fund investing.

By following the 8-4-3 rule and staying invested for the specified time periods, the investor experiences significant wealth accumulation through the magic of compounding. This real-life example underscores the importance of consistent investing and the remarkable growth potential offered by mutual fund investments over the long term.

Benefits of Long-Term Investing

Adopting a long-term perspective in investing brings several advantages that can significantly enhance the potential for wealth accumulation and financial security. The 8-4-3 rule is a prime example of how a long-term investment strategy capitalizes on the power of patience and time, leveraging the exponential growth potential of compounding. Below are the key benefits of long-term investing and how the 8-4-3 rule aligns with these advantages:

1. Compounding Returns:

The most significant advantage of long-term investing is the Power of compounding returns. Over time, the returns on an investment generate their own returns, leading to exponential growth. The 8-4-3 rule illustrates this beautifully, showing how an investment can double, quadruple, and then increase eightfold over successive periods. This demonstrates that the longer you invest, the greater the compounding effects, highlighting the importance of starting early and staying invested.

2. Reducing the Impact of Market Volatility:

Long-term investing helps mitigate the effects of short-term market volatility. By maintaining a long-term perspective, investors are less likely to make hasty decisions based on short-term market fluctuations, which can lead to poor investment outcomes. The 8-4-3 rule encourages investors to stay the course, focusing on the long-term growth potential rather than reacting to short-term market movements.

3. Lower Transaction Costs:

Investing with a long-term horizon typically involves fewer transactions than a more active trading strategy. This approach can significantly lower transaction costs, including trading fees and taxes on capital gains, which can erode investment returns over time. The 8-4-3 rule promotes a long-term investment strategy that minimizes unnecessary transactions, thereby maximizing net returns.

4. Emotional Stability:

Long-term investing can offer greater emotional stability by reducing the stress associated with monitoring and reacting to the daily movements of the financial markets. By adhering to the principles of the 8-4-3 rule, investors commit to a predefined timeline, which can help maintain focus on their long-term goals and reduce the temptation to act on short-term market sentiments.

5. Time to Recover from Downturns:

A long-term investment horizon provides time for investments to recover from downturns in the market cycle. Historically, markets have trended upwards over the long term, despite short-term fluctuations. The 8-4-3 rule implicitly acknowledges this by showing the substantial growth potential over extended periods, allowing investors to ride out periods of underperformance with confidence in eventual recovery.

6. Capitalizing on Growth Opportunities:

Long-term investors are well-positioned to capitalize on the growth opportunities presented by emerging trends and innovations. By staying invested through the various phases outlined in the 8-4-3 rule, investors can benefit from the growth of companies and sectors that lead the way in technological and economic advancements.

In conclusion, the benefits of long-term investing are manifold, offering investors a pathway to significant wealth accumulation through the power of compounding, reduced volatility impact, lower costs, emotional stability, recovery time, and the ability to capitalize on growth opportunities. The 8-4-3 rule serves as a guiding principle, emphasizing the importance of patience, discipline, and time in achieving financial success.

Implementing the 8-4-3 Rule

Implementing the 8-4-3 rule in your investment strategy requires a disciplined approach and a focus on long-term growth. Here are steps and tips to start investing with the 8-4-3 rule in mind, along with guidance on selecting mutual funds and the role of diversification in maximizing the rule’s effectiveness.

Steps to Start Investing with the 8-4-3 Rule

1. Define Your Investment Goals: Start by clearly defining your long-term investment goals. Whether it’s retirement, buying a home, or funding education, having a clear goal will help you stay committed to your investment plan over the long term.

2. Start Early: The power of the 8-4-3 rule is maximized when you start investing early. This gives your investments more time to compound, significantly enhancing the growth potential of your portfolio.

3. Regular Investments: Set up a systematic investment plan (SIP) in mutual funds to automate your investments. Regular monthly contributions can help build a substantial investment over time, leveraging the power of dollar-cost averaging.

4. Stay Committed: Commit to your investment plan for the long term. Avoid the temptation to withdraw your investments during market downturns or to chase short-term gains.

Tips for Selecting Mutual Funds

1. Research Fund Performance: Look for mutual funds with a consistent track record of strong performance over long periods. While past performance is not indicative of future results, it can give you an idea of the fund manager’s expertise.

2. Consider the Fund’s Investment Strategy: Select mutual funds whose investment strategies align with your long-term growth goals. Funds that focus on sectors with high growth potential, such as technology or healthcare, may offer greater returns over the long term.

3. Assess the Expense Ratio: Choose funds with a low expense ratio, as high fees can eat into your returns over time. A lower expense ratio means more of your money is working for you.

4. Check Fund Manager Tenure: A fund managed by the same individual or team for many years can be a sign of stable and experienced management, which is crucial for long-term investment success.

The Role of Diversification

Diversification is key to enhancing the effectiveness of the 8-4-3 rule. By spreading your investments across various asset classes, sectors, and geographies, you can reduce risk and smooth out returns over time.

1. Include Various Asset Classes: Your investment portfolio should include a mix of equities, fixed income, and other asset classes to balance risk and return.

2. Sector and Geographic Diversification: Invest in mutual funds that cover different sectors and regions to mitigate the impact of sector-specific or region-specific downturns.

3. Rebalance Regularly: Periodically review and rebalance your portfolio to maintain your desired asset allocation, ensuring that your investment strategy stays aligned with your long-term goals.

Implementing the 8-4-3 rule with these steps and tips can set a strong foundation for your investment journey, maximizing the potential for significant long-term growth. Remember, patience, discipline, and a well-thought-out strategy are your best allies in achieving financial success through investing.

Common Pitfalls to Avoid

Mutual fund investing, while offering the potential for significant returns, comes with its own set of risks and pitfalls. Being aware of these and adopting strategies to mitigate them can help investors stay disciplined and avoid common investment mistakes. Here are some key pitfalls to watch out for and tips on how to navigate them:

1. Chasing Past Performance

- Pitfall: Investors often select mutual funds based solely on their recent performance, assuming past success will continue into the future. This can lead to disappointment if the fund was performing well due to market conditions that no longer apply.

- Mitigation: Look beyond past performance. Consider the fund’s long-term track record, the consistency of returns, and how it fits within your overall investment strategy.

2. Ignoring Fees and Expenses

- Pitfall: High fees can significantly eat into your returns over time, especially in a low-return environment.

- Mitigation: Pay close attention to the expense ratio and other fees associated with a mutual fund. Opt for funds with lower fees that do not compromise on performance or your investment strategy.

3. Lack of Diversification

- Pitfall: Overconcentration in a single fund, sector, or asset class can expose your portfolio to higher risk.

- Mitigation: Ensure your investments are spread across various asset classes, sectors, and geographical regions to reduce risk and volatility. Rebalance your portfolio periodically to maintain this diversification.

4. Overreacting to Market Volatility

- Pitfall: Reacting impulsively to short-term market fluctuations can lead to poor investment decisions, such as selling low and buying high.

- Mitigation: Maintain a long-term perspective and resist the urge to make impulsive decisions based on short-term market movements. Remember, volatility is a normal part of investing.

5. Neglecting to Review and Rebalance

- Pitfall: Failing to periodically review and rebalance your portfolio can lead to an asset allocation that no longer aligns with your risk tolerance and investment goals.

- Mitigation: Regularly review your investment portfolio, at least annually, to ensure it remains aligned with your goals. Rebalance as necessary to maintain your desired asset allocation.

6. Falling Prey to Herd Mentality

- Pitfall: Following the crowd into the latest investment trend can lead to entering markets at their peak, increasing the risk of losses.

- Mitigation: Stick to your investment plan and avoid getting swayed by market trends and hype. Conduct thorough research before making any investment decisions.

7. Lack of Patience

- Pitfall: Impatience can lead investors to frequently switch funds in pursuit of higher returns, often to their detriment.

- Mitigation: Understand that investing is a long-term endeavor. Be patient and give your investments time to grow, keeping in mind the principles of the 8-4-3 rule.

By being mindful of these common pitfalls and adopting a disciplined approach to investing, you can significantly enhance your chances of achieving your financial goals through mutual fund investing. Stay informed, stay disciplined, and most importantly, stay focused on your long-term objectives.

The 8-4-3 rule offers a simple yet profound illustration of how compounding can dramatically transform mutual fund investments over time. By breaking down the investment journey into three distinct phases—doubling your investment in the first 8 years, quadrupling it in the next 4 years, and then seeing it grow eightfold in the final 3 years—this rule underscores the incredible power of patience and time in the realm of investing.

For individuals looking to secure their financial future, adopting a long-term investment strategy, as exemplified by the 8-4-3 rule, is essential. Starting early, making regular contributions to your investment portfolio, and maintaining a disciplined approach are key steps in leveraging the full potential of mutual fund investing. Furthermore, selecting the right mix of mutual funds, focusing on diversification, and avoiding common investment pitfalls are critical in navigating the complexities of the financial markets effectively.

In conclusion, the 8-4-3 rule not only highlights the transformative power of compounding over extended periods but also serves as a strategic guide for investors aiming to achieve their financial goals. By embracing a long-term investment strategy and staying committed to it, you can navigate through the volatility of the markets with confidence, ultimately realizing your financial aspirations. Let the 8-4-3 rule inspire you to embark on your investment journey with patience, discipline, and a clear focus on the future, paving the way for financial security and success.

⬇️You May Also Read ⬇️

➤Top 10 Powerful Reasons to Invest in Mutual Funds

➤Mastering Your Finances: The Ultimate Guide to Saving and Investing Smartly

➤Understanding Calculation of NAV, Sale and Repurchase Price in Mutual Funds: A Simple Guide

FAQ: Understanding the 8-4-3 Rule in Investing

What is the 8-4-3 rule in mutual funds?

The 8-4-3 rule is a concept illustrating the power of compounding in investments over time. It suggests that the compounding effect of an investment shows good results in the first 8 years, increases in speed in the next 4 years, and grows super-exponentially in the last 3 years.

How does the 8-4-3 rule benefit investors?

The 8-4-3 rule benefits investors by highlighting the importance of long-term investment and the significant impact that compounding can have on an investment’s growth over time. It encourages investors to remain patient and disciplined, leading to potential financial security and success.

Why is compounding important in investing?

Compounding is important because it allows the earnings from an investment to generate its own earnings. Over time, this process can make the investment grow exponentially, especially if returns are consistently reinvested.

Can the 8-4-3 rule be applied to any investment?

Yes, While the 8-4-3 rule specifically highlights the potential growth patterns in mutual funds and stock market, the underlying principle of compounding applies to a wide range of investments. The key is a long-term horizon and reinvestment of returns.

How can investors practically apply the 8-4-3 rule?

Investors can apply the 8-4-3 rule by committing to a long-term investment strategy, choosing investments with the potential for compounding returns, and consistently reinvesting those returns to maximize growth over time.

Does the 8-4-3 rule guarantee investment success?

No investment strategy, including the 8-4-3 rule, can guarantee success due to market volatility and other risks. However, this rule emphasizes the potential for significant growth through patience, discipline, and a focus on long-term investing.

How can investors manage risk while following the 8-4-3 rule?

Investors can manage risk by diversifying their investment portfolio, periodically reviewing and adjusting their investment choices, and staying informed about market trends and economic factors that may affect their investments.

Should younger or older investors consider the 8-4-3 rule?

The 8-4-3 rule is particularly beneficial for younger investors who have more time to allow their investments to compound. However, older investors can also benefit by incorporating it into their retirement planning and long-term investment strategies.

How does the 8-4-3 rule relate to financial goals?

The 8-4-3 rule serves as a strategic guide to help investors align their investment strategies with their long-term financial goals. By understanding and leveraging the power of compounding, investors can more effectively plan for future financial needs and aspirations.

Where can investors learn more about compounding and investment strategies?

Investors can learn more through financial education resources, investment advisors, financial blogs, and books on investing. Seeking professional financial advice is also recommended to tailor investment strategies to individual needs and goals.

2 thoughts on “Magic of the 8-4-3 Rule in Mutual Fund Investing”