Welcome to the world of mutual funds! If you’ve ever wondered about pooling money with others to invest wisely, you’re in the right place. In this blog post, we’ll break down the concept of mutual funds, explore how they work, and understand their roles and limitations in easy-to-understand terms.

What is Mutual Fund ?

- Mutual fund is a vehicle (in the form of a “trust”) to mobilize money from investors, to invest in different markets and Securities, in line with the common investment objectives agreed upon, between the mutual fund and the investors.

- A mutual fund is a means of raising money from investors to invest in a different markets and Securities (in the form of a “trust”).

Let’s break down the concept of a mutual fund in simple terms.

Understand the Concept of Mutual Fund

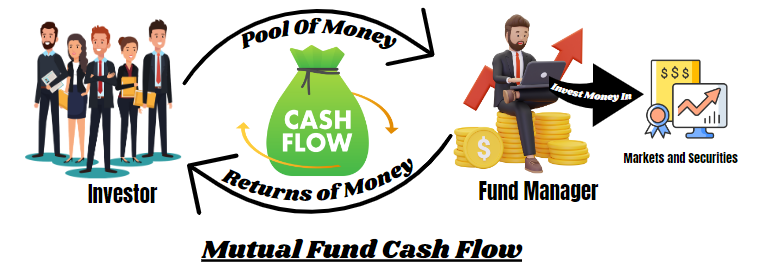

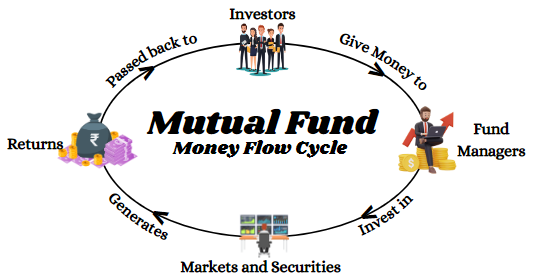

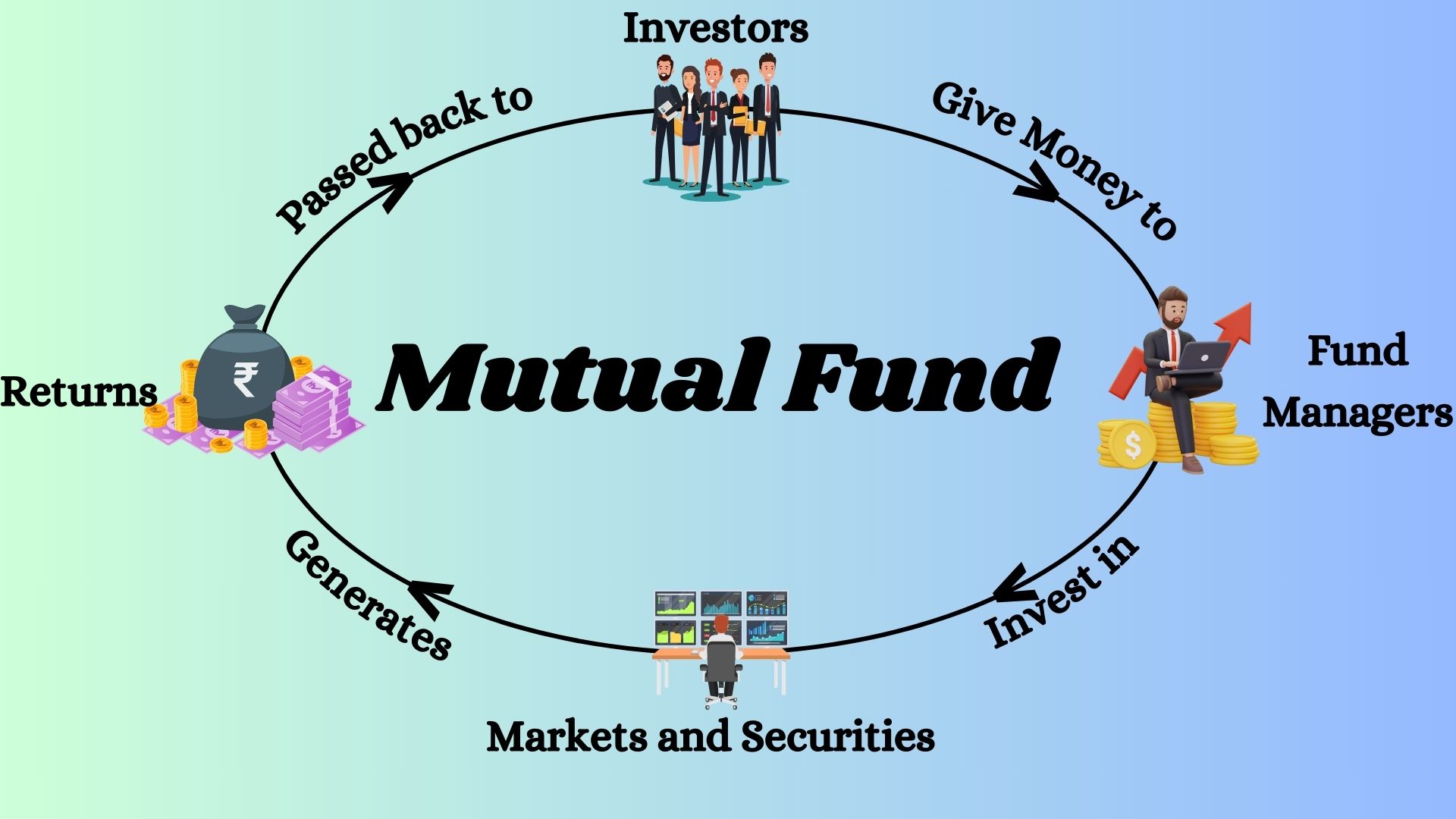

Imagine you and a group of friends decide to pool your money together to invest in something. Each friend contributes a certain amount of money, and together, you have a larger sum to invest. Now, instead of each person individually managing their investment, you appoint one person (let’s call them the fund manager) to make investment decisions on behalf of the group.

In the world of finance, this pooling of money by a group of investors to invest in a variety of stocks, bonds, Gold, Real Estate or other securities is similar to the Concept of a mutual fund.

So,

Mutual funds are a type of investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, Gold, Real Estate or other securities and Helps Investors to earn income or Building wealth.

The fund is managed by professional fund managers who use their expertise to make investment decisions on behalf of the investors. this person is an expert in financial markets and is responsible for choosing where to invest the pooled money. The investors own shares ( Called Units) in the mutual fund, which represent a portion of the total assets of the fund.

Let’s say you invest ₹100 in a mutual fund. The fund manager uses this money, along with contributions from others, to buy shares in various companies. If those companies do well, the value of the mutual fund increases, and the value of your ₹100 investment grows. If some companies face challenges, the fund manager might adjust the investments to minimize losses.

In summary, a mutual fund plays the role of a knowledgeable manager who helps a group of investors by wisely distributing their money across different investments, managing risks, and aiming for growth over time.

One of the main benefits of mutual funds is the ability to diversify investments. Because mutual funds invest in a variety of securities, the risk is spread out across multiple assets. Additionally, mutual funds are often more accessible to individual investors than purchasing individual stocks or bonds.

Mutual funds are also highly regulated, which can provide some level of stability and security for investors. They are required to disclose their holdings and performance on a regular basis, which makes it easier for investors to track their investments. However, it is important for investors to do their own research and understand the fees and risks associated with each mutual fund before investing.

6 Role of Mutual Fund

Mutual funds play different roles for the various people involved in them:

- Helping Investors: Their main job is to assist people in making money by taking part in opportunities in different investments like stocks and markets, whether for earning an income or growing their wealth.

- Raising Money: They collect money from investors, and this money is used, directly or indirectly, for various purposes like investing in projects or covering different expenses, benefiting governments and companies.

- Keeping an Eye on Companies: Since mutual funds are big investors, they can monitor and influence the way companies they invest in operate, ensuring good corporate governance and ethical standards.

- Supporting Jobs: The mutual fund industry provides jobs for many people, including employees of mutual funds, distributors, registrars, and other service providers, supporting their livelihoods.

- Boosting the Economy: More jobs, higher income, and increased economic activity contribute to higher government revenue through taxes and other means.

- Market Stabilization: Mutual funds can also help stabilize the market by balancing large inflows or outflows of money from foreign investors.

How Mutual Fund Schemes Operate:

Mutual fund schemes operate by pooling money from investors, having experts manage it, and giving investors a share of the profits or losses based on their contributions. It’s a teamwork approach to investing that aims to help individuals grow their money over time.

lets explore it :

- Investor Contributions: People like you and me contribute money to a mutual fund. It’s like chipping in to buy something together with a group of friends.

- Professional Management: Skilled managers, like captains of a sports team, are hired to decide where to invest the pooled money. They choose a mix of stocks, bonds, or other investments.

- Unit Ownership: When you invest in a mutual fund, you get units that represent your share of the overall investment. It’s like owning a piece of the whole group purchase.

- Value Fluctuations: The value of your units goes up or down based on how well the investments perform. It’s similar to the value of a sports team changing depending on their wins and losses.

- Distribution of Profits: If the fund makes a profit through dividends or selling investments, it’s shared among investors based on the number of units they own. It’s like sharing the winnings from a group activity.

- Types of Schemes: Mutual funds offer different types of schemes, such as equity funds (focused on stocks), debt funds (focused on bonds), or balanced funds (a mix). Investors can choose based on their preferences and goals.

- Fees and Expenses: Mutual funds may charge fees for managing the investments. It’s like contributing a small amount for the services provided by the professionals.

Understanding How Mutual Fund Investments Work

The mutual fund scheme makes money through its investments. When it buys and sells these investments, it either gains or loses money, known as capital gains or losses. MF also earn money come from interest or dividends.

Sometimes, The investments held by the scheme might be valued in the market at a price higher than the cost originally paid. This increase in the values of the securities is referred to as Valuation gains.

To know if the scheme is doing well, you can look at a positive metric calculated by adding interest income, dividend income, realized capital gains, and valuation gains, then subtracting losses and expenses.

Matric Formula = (A) Interest income + (B) Dividend income + (C) Realized capital gains + (D) Valuation gains – (E) Realized capital losses – Valuation losses – Scheme expenses.

Investments are considered to be managed profitably when the resulting metric is positive. Then true value of unit will increase and if resulting metric is negative than true value of unit will decrease.

When the investments are making money, the actual value of a unit goes up. Conversely, if there are losses, the real value of a unit goes down. This real value of a unit is also known as the Net Asset Value (NAV) of the scheme.

To meet different investor expectations, mutual funds offer various options like dividend payouts, re-investment of dividends, and growth options. we will discuss about this Topic in later posts.

Advantages of Mutual Funds for Investors

Mutual funds offer several advantages:

- Diversification: Mutual funds let you spread your money across different types of investments, like stocks and bonds. This helps reduce the risk because if one investment doesn’t do well, others might perform better.

- Professional Management: Expert fund managers make decisions on where to invest your money. They have the knowledge and experience to choose the right mix of investments, saving you from the need to make complex investment decisions.

- Accessibility: Even with a small amount of money, you can invest in a mutual fund. It allows you to be part of the financial markets without needing a large sum upfront, making investing more accessible.

- Liquidity: Mutual funds are usually easy to buy and sell. You can convert your mutual fund Units into cash quickly, providing liquidity compared to certain other types of investments.

- Convenience: Managing investments can be time-consuming. Mutual funds handle the buying, selling, and monitoring of investments, saving your time and effort.

- Cost Efficiency: Pooling money with other investors allows mutual funds to benefit from economies of scale. This means lower transaction costs and fees compared to managing individual investments.

- Regulation and Oversight: Mutual funds are regulated, and there is oversight to ensure fair practices. This provides a level of security for investors, knowing that their money is being managed within established rules.

- Variety of Options: There are various types of mutual funds catering to different investment goals. Whether you’re looking for income, growth, or a balance of both, there’s likely a mutual fund that suits your needs.

- Automatic Reinvestment: Many mutual funds offer the option to automatically reinvest any earnings (dividends or interest), helping your investment grow over time without requiring manual intervention.

- Transparency: Mutual funds regularly disclose their holdings and performance, providing investors with transparency and information to make informed decisions.

- Risk Management: With a diversified portfolio and risk management strategies, mutual funds aim to minimize the impact of market fluctuations on your overall investment.

- Flexibility: Mutual funds offer flexibility in terms of investment amount, allowing you to start with a modest sum and gradually increase your investment by Systematic Investment Plan (SIP) as your financial situation improves.

- Professional Research: Fund managers have access to extensive research and analysis tools, helping them make informed investment decisions based on market trends and economic conditions.

- Tax Deferral: Certain mutual funds, like retirement funds, ELSS, may provide tax advantages by allowing you to defer taxes on investment gains until you withdraw the money, potentially lowering your current tax liability.

Mutual funds offer diversification, professional management, accessibility, liquidity, convenience, cost efficiency, regulatory protection, and a variety of options, making them a popular and advantageous choice for many investors.

Limitations of Mutual Funds:

- Lack of portfolio customization: When you invest in a mutual fund, you can’t personally choose which specific stocks or investments the fund will buy. The fund manager makes those decisions based on the fund’s goals. Once you invest, you don’t have much say in customizing the portfolio according to your preferences.

- Fees and Costs: Mutual funds often charge fees for managing your investments. These fees can eat into your overall returns, like paying a small amount every time you use a service.

- Too Many Choices: There are many mutual fund options from 42 different companies, and each of them has various choices within their plans. This makes it hard for investors to pick the right one. To make things simpler, SEBI (Securities and Exchange Board of India) has grouped mutual funds into categories. This helps to make sure that similar types of funds offered by different companies have the same characteristics.

- Market Risks: Since mutual funds invest in stocks, bonds, or other securities, their value can go up or down based on market conditions. This means your investment is not guaranteed to always make money.

- Limited Control: When you invest in a mutual fund, you’re relying on a fund manager to make decisions. You have limited control over specific investments, like letting someone else choose the toppings for your pizza.

- Overdiversification: While diversification is good, having too many different investments might make it harder for the fund to perform exceptionally well in any specific area. It’s like having too many types of candies in a jar; some might not be your favorite.

- No Guaranteed Returns: Mutual funds don’t guarantee profits. The performance depends on the market, and there’s always a risk of losing money. It’s similar to not knowing for sure if a game will have a winner.

- Redemption Delays: When you want to sell your mutual fund shares, it may take some time to get your money. It’s not as quick as withdrawing money from a bank, and the value at the time of sale may be different from when you placed the request.

- Lack of Control over Costs: When you invest in a mutual fund, your money gets combined with others. The expenses for managing the fund are shared among all investors based on how much they’ve invested. As a result, each individual investor doesn’t have any say in deciding or controlling the costs of the fund

In our upcoming posts, we’ll explore mutual fund schemes, how they operate, and delve deeper into the advantages and limitations. Stay tuned for a journey into the world of mutual funds, making investing concepts simpler for everyone!

4 thoughts on “Mutual Fund And It’s Basic Concepts”