Mutual funds are a popular way for people to invest their money, aiming to grow their savings over time. But understanding how much money you’re making from these investments can be a bit tricky. That’s where our guide comes in handy! We dive deep into the world of mutual fund returns, breaking down the complex calculations into simple, easy-to-understand steps.

First, we’ll explore what mutual fund returns are and why they’re important for investors. Think of these returns as the money you earn (or sometimes lose) from investing in a mutual fund. It’s a way to measure how well your investment is doing. Then, we’ll guide you through the different methods used to calculate these returns. From the simple percentage increase method to more sophisticated techniques that consider the time you’ve held the investment, we cover it all.

But it’s not just about the numbers. Our guide also provides insights into what these calculations can tell you about your investment’s performance. We’ll help you understand what a good return looks like, how to compare your fund’s performance with others, and how external factors like market conditions and fees can impact your returns.

Whether you’re new to investing or looking to brush up on your knowledge, our in-depth guide to mutual fund returns will equip you with the tools you need to make informed decisions about your investments. So, get ready to demystify the complex world of mutual fund returns and gain valuable insights into making your money work harder for you.

You May Read: The Ultimate Guide to Saving and Investing Smartly

Mutual Fund Returns Calculation Techniques, Insights and Tips

Definition of Mutual Funds

What is a Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. This pool is managed by a professional fund manager. The idea is to provide individual investors access to a diversified portfolio that they might not be able to create on their own due to capital or knowledge constraints.

Key Points:

- Mutual funds collect money from many people and invest it.

- They buy a mix of different investments.

- Investors get a share of the profits or losses.

Importance of Understanding Mutual Fund Returns

Why do Mutual Fund Returns Matter?

When you invest in a mutual fund, you want to know how much money you might make (or lose). Understanding mutual fund returns helps you figure that out. Returns tell you how well your investment is doing over time. This helps you decide if it’s a good investment for your goals or not.

Understanding mutual fund returns is crucial for several reasons:

- Measure of Performance: Returns give you an idea of how well your investment is doing. If the mutual fund’s returns are consistently good, it means your investment is growing.

- Comparing Options: By looking at returns, you can compare different mutual funds to see which one is performing better, helping you make informed investment decisions.

- Financial Planning: Knowing potential returns helps you plan your financial future better. For instance, if you’re saving for retirement or a child’s education, understanding returns can help you estimate how much your investment might grow over time.

Key Points:

- Returns show how much money your investment is making (or losing).

- Helps you decide if the mutual fund is a good choice for you.

- Guides your investment decisions based on your goals.

Mutual Fund Returns Calculation

Basic Concept of Returns

When you invest money in a mutual fund, you hope that the money will grow over time. The increase in your investment’s value, compared to the initial amount you invested, is known as the return.

When we talk about returns in mutual funds, we’re essentially talking about how much money you’ve made (or lost) on your investment over a certain period of time, is known as the Return. Returns can be positive (you’ve made money) or negative (you’ve lost money).

For example, if you invest Rs1,00,000 in a mutual fund and it grows to R1,10,000, your return is Rs10,000.

Different Types of Returns in Mutual Funds

- Total Return: This measures the overall change in the value of your investment over a specific period, including any dividends or interest received and any capital gains or losses. It gives you a comprehensive view of how your investment has performed.

- Annualized Return: This is the average annual return on your investment over a certain period. It’s helpful for comparing the performance of investments held for different lengths of time.

- Compound Annual Growth Rate (CAGR): This is another way of expressing the annualized return, particularly useful for understanding the consistent growth rate of an investment over time.

I will explain in detail “How are these Mutual Fund Returns Calculated?” in this post later, So keep patience.

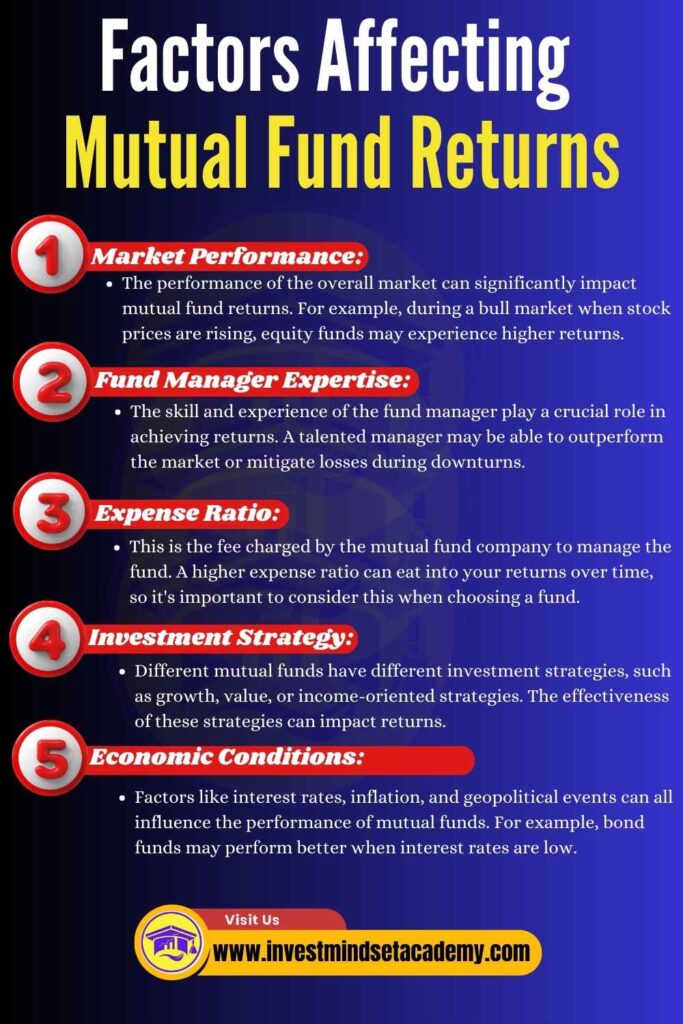

Factors Affecting Mutual Fund Returns

- Market Performance: The performance of the overall market can significantly impact mutual fund returns. For example, during a bull market when stock prices are rising, equity funds may experience higher returns.

- Fund Manager Expertise: The skill and experience of the fund manager play a crucial role in achieving returns. A talented manager may be able to outperform the market or mitigate losses during downturns.

- Expense Ratio: This is the fee charged by the mutual fund company to manage the fund. A higher expense ratio can eat into your returns over time, so it’s important to consider this when choosing a fund.

- Investment Strategy: Different mutual funds have different investment strategies, such as growth, value, or income-oriented strategies. The effectiveness of these strategies can impact returns.

- Economic Conditions: Factors like interest rates, inflation, and geopolitical events can all influence the performance of mutual funds. For example, bond funds may perform better when interest rates are low.

Understanding these factors can help investors make informed decisions about their mutual fund investments and set realistic expectations for returns.

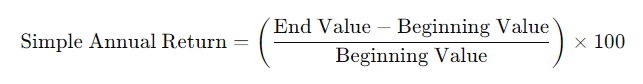

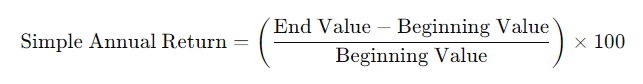

Explanation of Simple Annual Return Calculation

Simple Annual Return measures how much an investment has earned or lost over one year, expressed as a percentage. This method is straightforward and gives you a quick snapshot of an investment’s performance over a year, without considering compounding.

The formula for Simple Annual Return

The formula to calculate the Simple Annual Return is:

Where:

- End Value is the value of the investment at the end of the year.

- Beginning Value is the value of the investment at the beginning of the year.

Example to understand SIA Calculation:

Let’s say you invested Rs1,000 in a mutual fund, and at the end of the year, the value of your investment grew to Rs1,200.

Using the formula:

So, the Simple Annual Return on your investment is 20%. This means your investment has grown by 20% over the year.

Pros and Cons of Simple Annual Return

| Pros | Cons |

|---|---|

| Simplicity The calculation is straightforward and easy to understand. You just need the beginning and ending values of your investment over a year. | Ignores Compounding It does not take into account the compounding of returns within the year, which can be a significant factor in investment growth. |

| Quick Comparison It helps in quick comparison of the performance of different investments over a one-year period. | Not Suitable for Multiple Years It Can be misleading if used to compare returns over periods longer than a year because it doesn’t average the returns over the total period. |

| Can Oversimplify While the simplicity can be advantageous, it can also overlook other factors affecting the investment’s performance, such as volatility or the impact of additional investments or withdrawals. |

Note :- the Simple Annual Return is a helpful tool for quickly assessing an investment’s yearly performance in straightforward cases. However, for more nuanced or long-term investment evaluations, other metrics like the Compound Annual Growth Rate (CAGR) might be more informative. Always consider using the Simple Annual Return in conjunction with other metrics to get a fuller picture of an investment’s performance.

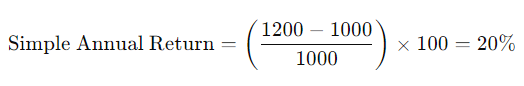

Explanation of CAGR (Compound Annual Growth Rate)

The Compound Annual Growth Rate (CAGR) is a measure used to indicate the yearly growth rate of an investment over a specific time period longer than one year.

It represents one of the most accurate ways to calculate and determine returns for anything that can rise or fall in value over time. Importantly, CAGR smooths out the progression of an investment’s return as if it had grown at a steady rate, which is rarely the case in reality.

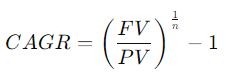

Formula for CAGR Calculation

The formula to calculate CAGR is:

Where:

- FV = Future Value of the investment

- PV = Present Value of the investment

- n = Number of years

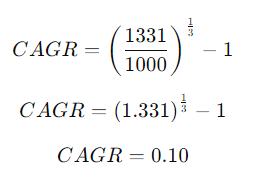

Example Calculation

Let’s say you invested Rs1,000 in a mutual fund, and after 3 years, your investment is worth Rs1,331.

Using the CAGR formula:

Or in percentage form, CAGR=10%.

This means your investment has grown at an average rate of 10% per year over the 3-year period.

Advantages of Using CAGR

- Standardized Measure: CAGR provides a standardized way to compare the growth rates of different investments over the same time period, regardless of their initial and final values.

- Reflects Compounding Effect: CAGR takes into account the compounding effect, giving a more accurate representation of the investment’s growth rate over time.

- Simplicity: Provides a single, smoothed annual rate that simplifies the comparison between different investments over different periods.

- Effectiveness: Reflects the effect of compounding, unlike average returns that simply divide the total growth by the number of years.

- Comparability: Allows for the comparison of investment performance regardless of volatility or the period of investment.

Limitations of CAGR

- Assumes Steady Growth: CAGR assumes that the investment grows at a steady rate over the entire period, which may not always be the case in reality.

- Sensitive to Time Period: CAGR can vary significantly depending on the time period chosen for calculation. Small changes in the beginning or ending values can lead to large differences in the calculated CAGR.

- Ignores Volatility: CAGR does not account for the risk or volatility of the investment. Two investments might have the same CAGR but very different risk profiles.

- Assumes Reinvestment: It assumes profits are reinvested at the end of each period, which might not always be the case.

- Not for Irregular Investments: CAGR is less useful for investments where deposits and withdrawals are made throughout the period.

While CAGR is a useful tool to understand the average growth of an investment over multiple years, it’s important to consider its limitations. Investors should use CAGR as one of several metrics in evaluating their investment choices, keeping in mind the overall risk and their investment goals.

Steps to Calculate Mutual Fund Returns

Calculating mutual fund returns may seem challenging at first, but breaking it down into steps makes it more manageable. Let’s explore these steps in simple terms, with examples to help clarify each one.

Step 1: Gather Necessary Data

Before you can calculate the return on your mutual fund investment, you need specific pieces of information:

- Initial Investment Amount: How much money you originally invested.

- Final Value of Investment: The current or end value of your investment.

- Investment Horizon: The time period over which you held the investment.

Example: Suppose you invested Rs1,000 in a mutual fund (Initial Investment Amount). After 5 years, the investment is worth Rs1,300 (Final Value of Investment).

Step 2: Calculate Investment Horizon

The investment horizon is the total time you’ve held the investment. It’s crucial because the length of time you invest affects how you’ll calculate the return, especially if you’re looking for an annualized return.

Example: If you bought into the mutual fund on January 1, 2015, and today is January 1, 2020, your investment horizon is 5 years.

Step 3: Choose the Right Calculation Method

Depending on what you want to find out, you’ll choose a different method to calculate returns. The two main methods are:

- Absolute Returns: Used for investments held for any period. It shows the total return without annualizing.

- Annualized Returns: Used for comparing the performance of investments held over different periods. It shows the yearly average return, considering compounding.

Example: Using our initial Rs1,000 investment which grew to Rs1,300 over 5 years, if you just want to know how much it grew in total, use the absolute return method. For comparing it with another investment or to understand the yearly growth rate, use the annualized return method.

Step 4: Plug in the Numbers

Now, you apply your chosen method using the data you’ve gathered.

For Absolute Returns: The formula is

For Annualized Returns: The formula is

Example:

For the absolute return on our Rs1,000 investment that grew to Rs1,300 over 5 years, the calculation would be (1300−1000)/1000×100=30(1300−1000)/1000×100=30.

For the annualized return, it would be ((1300/1000)1/5)−1)×100=5.38((1300/1000)1/5)−1)×100=5.38, approximately.

Step 5: Interpret the Results

Understanding what the numbers mean is crucial:

- Absolute Return tells you how much the investment has grown over the total period.

- Annualized Return gives you an average yearly growth rate, making it easier to compare different investments.

So, A 30% absolute return tells you that, overall, your investment grew by 30% over 5 years. The 5.38% annualized return tells you that, on average, your investment grew by about 5.38% each year, which is useful for comparing it to other investments or the inflation rate.

Remember, these calculations can give you a good indication of past performance but are not predictors of future returns. It’s also important to consider fees, taxes, and other factors that can affect your net returns.

How to Make Investment Decisions Using Mutual Fund Returns

How to use mutual fund returns to make smarter investment decisions?

This process involves looking at past performance, comparing returns to benchmarks, understanding risk-adjusted returns, and setting realistic expectations for future investments. I’ll explain each of these steps in simple terms and provide examples to make it easier to grasp.

Assessing Historical Performance

Historical performance of a mutual fund tells you how well it has done in the past.

Assessing Historical Performance

When you’re looking at a mutual fund, one of the first things you might look at is its historical performance. Historical performance of a mutual fund tells you how well it has done in the past, say, 1, 3, 5, or even 10 years. However, While past performance is not a guarantee of future results, it can give you an idea of the fund’s track record and how the fund has managed through different market conditions.

Here’s how you can assess historical performance:

- Check the Fund’s Track Record: Look at how the mutual fund has performed over different time periods, like 1 year, 3 years, 5 years, and so on. This will give you an idea of its consistency.

- Compare Performance to Similar Funds: See how the fund’s performance stacks up against other mutual funds in the same category. For example, if you’re looking at a large-cap equity fund, compare its returns to other large-cap equity funds.

Example: Imagine two mutual funds, Fund A and Fund B. Over the past 5 years, Fund A showed returns of 8% per year, while Fund B showed 6% per year. While Fund A seems more attractive, it’s essential to look deeper into how these returns were achieved, including the risks taken.

Comparing Returns with Benchmarks

Mutual funds are often compared to benchmarks, which are indices that represent a particular market or sector. Comparing a fund’s returns to its benchmark can help you understand how well it’s performing relative to the broader market. Here’s how you can do it:

- Identify the Benchmark: Find out which benchmark is most relevant to the mutual fund you’re considering. For example, if you’re looking at an international equity fund, its benchmark might be the MSCI World Index. If you are looking for small Cap Mutual Fund, its benchmark would be NIFTY Smallcap 100 Index.

- Evaluate Relative Performance: Compare the fund’s returns to the benchmark over the same time periods. If the fund consistently outperforms its benchmark, it may indicate skilled management or a unique investment strategy.

Example: If Fund A, an equity mutual fund, returned 10% in a year when the S&P 500 (its benchmark) returned 8%, Fund A outperformed the market. However, if Fund B, another equity fund, returned only 6%, it underperformed compared to the benchmark.

Understanding Risk-adjusted Returns

Risk-adjusted returns consider not just the returns a fund has generated but also the risks taken to achieve those returns. A fund that achieves high returns with high volatility (risk) might not be as attractive as a fund with slightly lower returns but much lower volatility, especially for risk-averse investors.

Example: Let’s say Fund C has an annual return of 12% with high volatility, while Fund D has a 10% return with low volatility. For someone who wants to avoid large swings in their investment value, Fund D might be the better choice, even though its returns are lower because it offers a better risk-adjusted return.

Setting Realistic Expectations

It’s important to have realistic expectations about mutual fund returns. Markets fluctuate, and different asset classes (like stocks, bonds) have different risk and return profiles. Understanding that high returns usually come with high risk is crucial, and aligning your investment choices with your risk tolerance and financial goals is essential.

Example: An investor looking for safety and modest growth might choose a bond fund or a balanced fund (which invests in a mix of stocks and bonds), expecting returns in the range of 4% to 6% per year, which is generally lower than what pure stock funds might aim for but also comes with lower risk.

Using This Information

When making investment decisions:

- Review Historical Performance: But remember it doesn’t guarantee future results.

- Compare with Benchmarks: To understand how well the fund performs compared to the market or its peers.

- Consider Risk-adjusted Returns: High returns are attractive, but understanding the risks involved is crucial.

- Set Realistic Expectations: Based on your risk tolerance and financial goals.

By taking these steps, you’ll be better equipped to choose mutual funds that align with your investment strategy, helping you work towards your financial goals more effectively.

⬇️You May Also Read ⬇️

➤Your Secret Weapon for Tax Savings: House Rent Allowance (HRA) and Other allowances

➤Mastering Income Tax savings: A Beginner’s Guide to Save Money Legally

➤Top 10 Powerful Reasons to Invest in Mutual Funds

➤Understanding Calculation of NAV, Sale and Repurchase Price in Mutual Funds: A Simple Guide

FAQs on Mutual Fund Returns: Understanding, Calculation, and Decision Making

Why are mutual fund returns important?

Mutual fund returns are important because they indicate the performance of your investment over time, helping you assess whether it aligns with your financial goals.

How are mutual fund returns calculated?

Mutual fund returns can be calculated using different methods such as simple annual return, total return, annualized return, and Compound Annual Growth Rate (CAGR), each providing different insights into the investment’s performance.

What factors affect mutual fund returns?

Factors that can affect mutual fund returns include market performance, the expertise of the fund manager, the fund’s expense ratio, its investment strategy, and current economic conditions.

What is the Simple Annual Return, and how is it calculated?

The Simple Annual Return measures an investment’s growth over one year without considering compounding, calculated by comparing the investment’s end value to its beginning value over a year.

What is CAGR, and why is it useful?

The Compound Annual Growth Rate (CAGR) calculates the mean annual growth rate of an investment over a specified time longer than one year, providing a smoothed indication of growth and factoring in the effect of compounding.

What are the pros and cons of using the Simple Annual Return?

The Simple Annual Return is straightforward and useful for quick comparisons but ignores compounding and might oversimplify the investment’s performance, making it less suitable for evaluating long-term or nuanced investments.

How do you assess the historical performance of a mutual fund?

Assess a mutual fund’s historical performance by examining its track record over various time periods, comparing it to similar funds, and evaluating its performance against relevant benchmarks.

How can comparing mutual fund returns to benchmarks help in investment decisions?

Comparing returns to benchmarks helps you understand how well the fund is performing relative to the broader market or its category, indicating the fund manager’s skill and the effectiveness of its investment strategy.

Why are risk-adjusted returns important, and how can they influence investment decisions?

Risk-adjusted returns consider both the returns and the risks taken to achieve them, helping investors choose funds that align with their risk tolerance and providing a more complete picture of the fund’s performance.

What is CAGR, and how is it calculated?

Compound Annual Growth Rate (CAGR) is a measure that indicates the yearly growth rate of an investment over a specific period longer than one year. It’s calculated using a formula that accounts for the investment’s initial value, final value, and the time period.

What should I consider when setting expectations for mutual fund returns?

Understand that markets fluctuate and different asset classes have varying risk and return profiles. High returns usually come with higher risk, so align your investment choices with your risk tolerance and financial goals.

1 thought on “An In-Depth Guide to Mutual Fund Returns: Calculation Techniques, Insights and Tips”