Investing in mutual funds can be a fantastic way to grow your wealth, but it’s essential to understand the rules that govern these investments. One critical aspect is the Net Asset Value (NAV), a crucial factor in determining the value of your mutual fund units. Recently, there have been updates to the NAV rules that you should be aware of, effective from February 1, 2021. Aim of This rule is to ensure fairness and transparency in the buying and selling of mutual fund units.

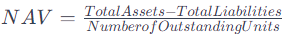

What is NAV and Why Does it Matter?

Net Asset Value (NAV) is essentially the price per unit of a mutual fund or simply ,we can say that NAV is the market value of one unit of a mutual fund. It’s the value of all the assets minus the liabilities, divided by the total number of units. NAV is crucial because it determines the cost of buying or selling mutual fund units. it also helps you understand the value of your investment.

Cut-off Timings for Mutual Fund Transactions

Starting from February 1, 2021, there’s a new rule that affects the NAV calculation. According to SEBI circulars, the applicable NAV for purchasing mutual fund units now depends on the realization and availability of funds in the mutual fund’s bank account before the cut-off timings.

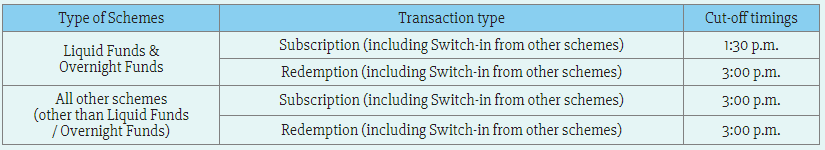

What are Cut-off Timings?

Cut-off timings are specific deadlines for mutual fund transactions. These timings vary based on the type of mutual fund, such as Liquid Funds, Overnight Funds, or others.

To determine the Net Asset Value (NAV) for subscription and redemption transactions, the following cut-off timings are applicable for various types of schemes:

- Liquid Funds & Overnight Funds:

- Subscription: 1:30 p.m.

- Redemption: 3:00 p.m.

- All Other Schemes (excluding Liquid & Overnight Funds):

- Subscription: 3:00 p.m.

- Redemption: 3:00 p.m.

How Does NAV Based on Realization Work?

The applicable NAV is determined by the time of your transaction and when the funds become available. Here’s a simplified breakdown:

- If your transaction and funds are in by 3:00 p.m. on a business day, the NAV for that day applies.

- If your transaction is in before 3:00 p.m. but funds become available after, the NAV of the next business day is used.

- If your transaction is after 3:00 p.m. but funds are in by 3:00 p.m. on the same day, the NAV of the next business day is applicable.

- If both your transaction and funds are in after 3:00 p.m., the NAV of the subsequent business day with funds realized before 3:00 p.m. is used.

| Time of Receipt of Transaction and Money | Applicable NAV |

|---|---|

| Up to the cut-off time of 3:00 p.m. on a business day, funds available by 3:00 p.m. | NAV of the same Business Day |

| Up to the cut-off time of 3:00 p.m. on a business day, funds available after 3:00 p.m. | NAV of the subsequent Business Day |

| After the cut-off time of 3:00 p.m. on a business day, funds available by 3:00 p.m. | NAV of the subsequent Business Day |

| After the cut-off time of 3:00 p.m. on a business day, funds available after 3:00 p.m. | NAV of the subsequent Business Day with prior funds |

lets understand this in more details

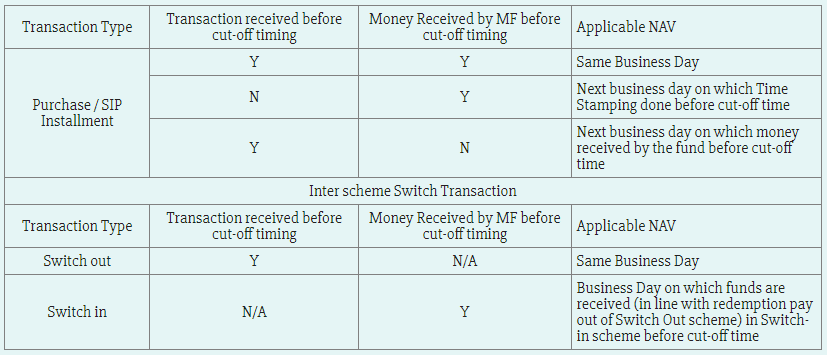

HOW IS THE RELEVANT NAV DETERMINED?

The Applicable NAV for purchase transactions (including Switch-In transactions) under all mutual fund schemes (excluding Liquid funds and Overnight Funds) irrespective of the investment amount, is determined as follows:

- Time of Transaction and Availability of Funds:

- If the purchase transaction is received by the official point(s) of acceptance up to the cut-off time of 3.00 p.m. on a business day, and funds for the entire subscription/purchase amount are available for utilization by 3.00 p.m. on the same Business Day, the NAV of that Business Day applies.

- Transaction After 3.00 p.m.:

- If the transaction is received by the official point(s) of acceptance up to the cut-off time of 3.00 p.m. on a business day, but funds for the purchase of units are available for utilization after 3.00 p.m. on that Business Day or on a subsequent Business Day, the NAV of the subsequent Business Day with available funds prior to 3.00 p.m. is applicable.

- Transaction Received After 3.00 p.m.:

- If the transaction is received after the cut-off time of 3.00 p.m. on a business day at the official point(s) of acceptance, and funds for the entire subscription/purchase amount are available for utilization by 3.00 p.m. on the same Business Day, the NAV of the subsequent Business Day applies.

- Late Application After 3.00 p.m.:

- In cases where the application is received after the cut-off time of 3.00 p.m. on a business day at the official point(s) of acceptance, and funds for the entire subscription/purchase amount are available for utilization after 3.00 p.m. on the same Business Day or a subsequent Business Day, the NAV of the subsequent Business Day, on which funds are realized prior to 3.00 p.m., is applicable

Examples to Make it Clear

Lump Sum Purchase: Let’s say you invest ₹10,000 before 3:00 p.m. on February 11, 2021. If the funds arrive in the mutual fund’s account by the cut-off time, you get the NAV of February 11. If the funds come in after 3:00 p.m., your units are allotted at the NAV of February 12.

SIP Transaction: For a systematic investment plan (SIP), if you’ve set up a ₹5,000 installment on the 10th of every month, you’ll get the NAV for the 10th only if the money is received by 3:00 p.m. If not, you get the NAV of the next business day before the cut-off time.

NAV Applicability Matrix Based on Transactions (Effective from February 1, 2021)

Understanding these NAV rules is essential for making informed investment decisions and ensuring that you get the most out of your mutual fund investments.

Main source – https://www.amfiindia.com/investor-corner/knowledge-center/cut-off-timings.html

If you have properly understand this New Mutual Fund NAV Rules , Then Please attempt QUIZ given Below

2 thoughts on “Understanding the New Mutual Fund NAV Rules of Cut-off Timings”