Hello friends, I thinks , you all are getting salary every month on your bank account , Right ? But are you happy with how much you’re getting paid? That’s the first thing to think about. If you’re not happy, you might need to improve your skills or ask for a raise. But let’s say you’re okay with your salary for now.

Then, have you ever looked at your salary slip? It’s that piece of paper or digital document that shows how much money you’re getting paid and where it’s coming from. If you haven’t looked at it yet, take a moment to check it out. It’s important because it contains some valuable information that can help you in tax savings smartly.

You might have heard of something called CTC, which stands for Cost to Company. It’s the total amount of money your employer says they’re going to pay you. But here’s the thing: what you see in your bank account every month is often less than what they promise. That’s because your salary is made up of different parts.

The most common part is your Basic Salary. This is the main chunk of money you get paid. But there are other things too, like allowances. Now, you might wonder why companies don’t just pay everything as basic salary. Well, that’s where things like the Provident Fund (PF) come in.

The PF is like a savings account for your retirement. A certain amount gets deducted from your salary every month, and your employer also adds to it. But here’s the trick: the more basic salary you have, the more your employer has to put into your PF. And they don’t want to do that because it costs them money.

But if your basic salary is lower, it opens up the possibility for other allowances. And here’s the cool part: some of these allowances aren’t taxed! That means you get to keep more of your money instead of giving it to the government.

So, looking closely at your salary slip and understanding these different parts can help you figure out how to keep more of your money. It’s all about playing the game smartly, with the right balance of basic salary and those tax-saving allowances.

So, by adjusting your salary structure to have a lower basic salary and more allowances, you can actually save money on taxes. But it’s not always straightforward, and there are pros and cons to consider. We’ll dive into that next.

You may read: Mastering Income Tax savings: A Beginner’s Guide to Save Money Legally

Understanding HRA (House Rent Allowance)

House Rent Allowance(HRA) is basically money given to you to help pay for where you live. The cool part? If you’re actually using this money to pay rent, you don’t have to pay tax on it. That’s right, it’s like getting a tax-free gift every month just for paying your rent. But, if you’re not using it for rent (say, you live in your own house), then you need to pay tax on this amount. Fair enough, right?

So, HRA is a component of your salary designed to cover housing rent. It offers significant tax-saving potential if used correctly. for this you have to understand Tax implications and salary Optimization Strategy.

Tax Implications: The amount of HRA exempt from tax depends on various factors, including the actual HRA received, the basic salary, and the rent paid. The goal is to optimize these factors to maximize tax savings.

Optimization Strategy: By adjusting the Basic Salary and HRA proportion, you can increase the non-taxable portion of your income. However, this requires careful consideration to avoid reducing benefits like the Provident Fund (PF) contribution.

you can Learn more about HRA from Here

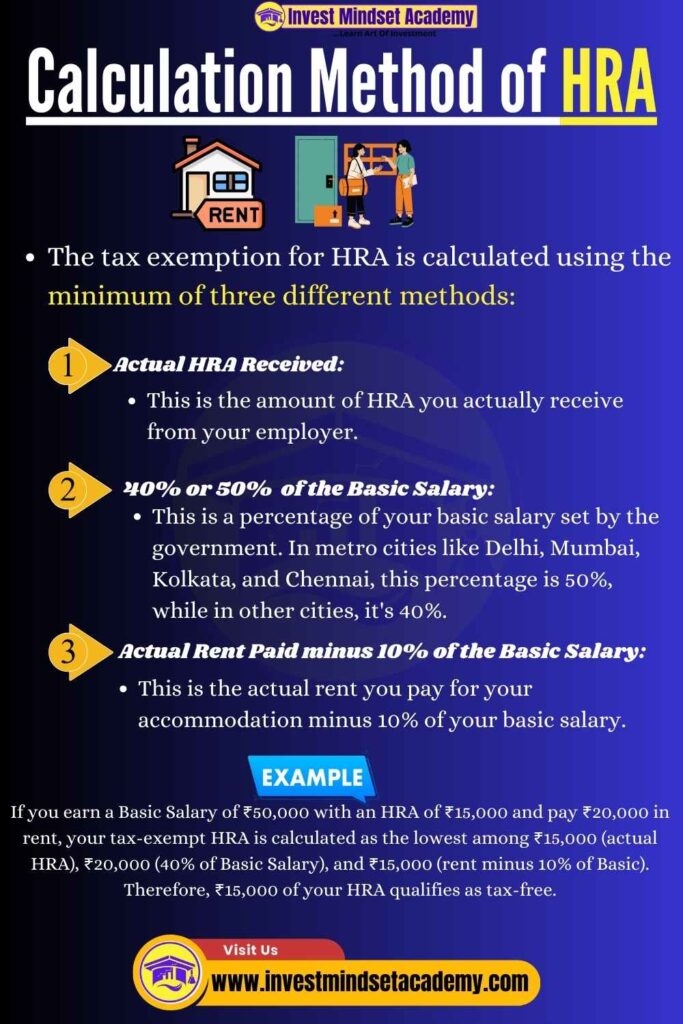

Calculation Method of House Rent Allowance

The tax exemption for HRA is calculated using the minimum of three different methods:

- Actual HRA Received: This is the amount of HRA you actually receive from your employer.

- 40% (or 50% in metro cities) of the Basic Salary: This is a percentage of your basic salary set by the government. In metro cities like Delhi, Mumbai, Kolkata, and Chennai, this percentage is 50%, while in other cities, it’s 40%.

- Actual Rent Paid minus 10% of the Basic Salary: This is the actual rent you pay for your accommodation minus 10% of your basic salary.

Let’s Dive Into an Example:

Let’s say you earn a Basic Salary of ₹50,000 per month. Your company is pretty generous and gives you an HRA of ₹15,000 per month. But your landlord is even greedier, and you end up paying ₹20,000 per month for your cozy apartment.

Now, let’s do the math to find out how much of that HRA you don’t have to pay taxes on:

- The actual HRA you receive is ₹15,000.

- 40% of your Basic Salary (since we’re assuming you don’t live in a metro city for this example) would be 40% of ₹50,000, which equals ₹20,000.

- The rent you pay minus 10% of your Basic Salary would be ₹20,000 – (10% of ₹50,000), so ₹20,000 – ₹5,000 = ₹15,000.

Now, remember, the rule is to pick the lowest of these three numbers. In this case, it’s ₹15,000, which comes from both the actual HRA received and the rent paid minus 10% of the Basic Salary. So, ₹15,000 of your HRA is what you can consider as tax-free.

Negotiation to save more taxes

Negotiating your salary structure is like bargaining for a better deal on your paycheck. It’s super important because it can help you save a lot of money on taxes. Let me break it down for you:

Importance of Negotiation:

When you negotiate your salary structure, you’re basically trying to adjust how much money you get paid and how it’s divided up. This is really important because it can affect how much tax you have to pay. For example, if you can get more of your salary in the form of HRA (House Rent Allowance), you might be able to lower the amount of tax you owe.

Let’s say you currently have a basic salary of Rs. 50,000 per month and an HRA of Rs. 15,000 per month. By negotiating with your employer, you might be able to lower your basic salary to Rs. 45,000 and increase your HRA to Rs. 20,000. This could help you save a lot of money on taxes because HRA is often exempt from tax.

Impact on PF and Other Benefits:

But here’s the catch: when you lower your basic salary, it can also reduce the amount of money your employer contributes to your PF (Provident Fund). This is like a long-term savings account for your retirement. So, it’s really important to make sure you negotiate other benefits to make up for any potential losses in your PF savings.

For example, if your employer agrees to lower your basic salary, you could ask them to increase other allowances, like medical or travel allowances, to make sure your overall compensation (known as CTC) stays the same. This way, you can still save money on taxes without sacrificing your long-term savings.

So, negotiating your salary structure is a smart move that can help you keep more money in your pocket both now and in the future. It’s all about finding the right balance and making sure you’re getting the best deal possible.

Other Allowances: Tax Savings Beyond HRA

HRA can be a bit of a puzzle, right? You need to calculate, compare, and then claim the least of three amounts to figure out your tax exemption. But, when we shift our focus to other allowances, the picture gets a lot less complicated. For instance:

- Leave Travel Allowance (LTA): Imagine your company offers you LTA. This means you can claim tax exemptions on the travel expenses for a vacation within India. So, if you spend ₹20,000 on flight tickets for a family trip to Kerala, you can claim this amount as non-taxable, provided you submit the bills to your employer. Simple!

- Mobile Reimbursement: Many companies offer a monthly allowance for mobile or internet expenses. If you have a ₹1,000 mobile bill every month and your company provides a ₹1,000 mobile allowance, you can get this amount tax-free. Just submit your monthly bills, and voila, no taxes on this part of your income.

Must use every little bit helps when it comes to saving on taxes. Leveraging all available allowances not only simplifies the process but also ensures you’re not leaving any money on the table. For example:

- Food Coupons: Suppose your company offers food coupons worth ₹2,500 per month that are exempt from tax. Over a year, that’s a straight ₹30,000 of your income not subject to taxes, just for eating!

- Book and Periodical Allowance: If you’re a reader, this one’s for you. Say your employer provides an allowance of ₹500 per month for books and periodicals. That’s ₹6,000 a year you can claim for doing nothing more than buying books and magazines you’d probably purchase anyway.

By tapping into these allowances, you effectively reduce your taxable income, which in turn lowers your tax bill. It’s about making smart choices with the benefits your employer offers. Each allowance might seem small on its own, but together, they can add up to significant savings.

In conclusion, while HRA is a powerful tool for tax savings, don’t overlook the simpler, less complicated allowances available to you. These straightforward benefits not only make the tax-saving process easier but also enhance your overall financial well-being. So, take a closer look at your salary structure, understand the allowances you’re entitled to, and make the most of them to maximize your take-home pay.

To sum it up, HRA is a fantastic way to save on taxes if you’re paying rent. Just make sure to play around with the numbers to maximize your tax benefits while also keeping an eye on your overall financial health, like your PF contributions. And if you’re not getting HRA or are self-employed, there might still be ways to claim similar benefits under different sections of the tax laws. Always keep looking for those opportunities!

⬇️You May Also Read ⬇️

➤Mastering Your Finances: The Ultimate Guide to Saving and Investing Smartly

➤Top 10 Powerful Reasons to Invest in Mutual Funds

➤Understanding Calculation of NAV, Sale and Repurchase Price in Mutual Funds: A Simple Guide

Why can’t my salary be fully given as Basic Salary?

Basic Salary attracts full taxes and mandates a higher PF contribution from employers. By structuring salary with allowances, you can save on taxes and your employer can save on PF contributions.

What is PF and how does it affect my salary?

PF stands for Provident Fund, a retirement savings scheme where both you and your employer contribute a part of your salary. It’s deducted from your salary, affecting your in-hand amount.

How can I save taxes with HRA?

If you’re paying rent, HRA can be tax-exempt based on calculations involving your rent, basic salary, and actual HRA received. Maximizing HRA benefits can significantly reduce your taxable income.

Is it possible to adjust my salary structure for tax benefits?

Yes, negotiating a salary structure with a lower basic salary and higher allowances like HRA can optimize tax savings. However, consider its impact on PF and other benefits.

What are other allowances that can save taxes beyond HRA?

Allowances like Leave Travel Allowance (LTA), mobile reimbursements, food coupons, and book allowances can offer tax savings. They’re simpler to claim and don’t require complex calculations like HRA.

How does Leave Travel Allowance (LTA) work for tax savings?

LTA allows tax exemptions on travel expenses within India, provided you submit proof of expenditure to your employer. It’s a straightforward way to save taxes on vacation expenses.

Can I claim tax exemption on my phone and internet bills?

Yes, if your employer provides a specific allowance for it and you submit your bills, the amount up to the allowance can be exempt from taxes.

How do food coupons contribute to tax savings?

Food coupons provided by your employer are exempt from taxes up to a certain limit, directly reducing your taxable income.

What should I do if I don’t get HRA or am self-employed?

Even without HRA, you may qualify for tax benefits under Section 80GG if you’re paying rent. Additionally, self-employed individuals can claim certain expenses as business expenses to lower taxable income.

4 thoughts on “Your Secret Weapon for Tax Savings: House Rent Allowance (HRA) and Other allowances”