Let us delve deeper into the concept of bond pricing and understand how it is affected by the relationship between the coupon rate of the bond and the interest rates prevailing in the market. Then I’ll provide a couple of examples to illustrate the Concepts.

What is Bond ?

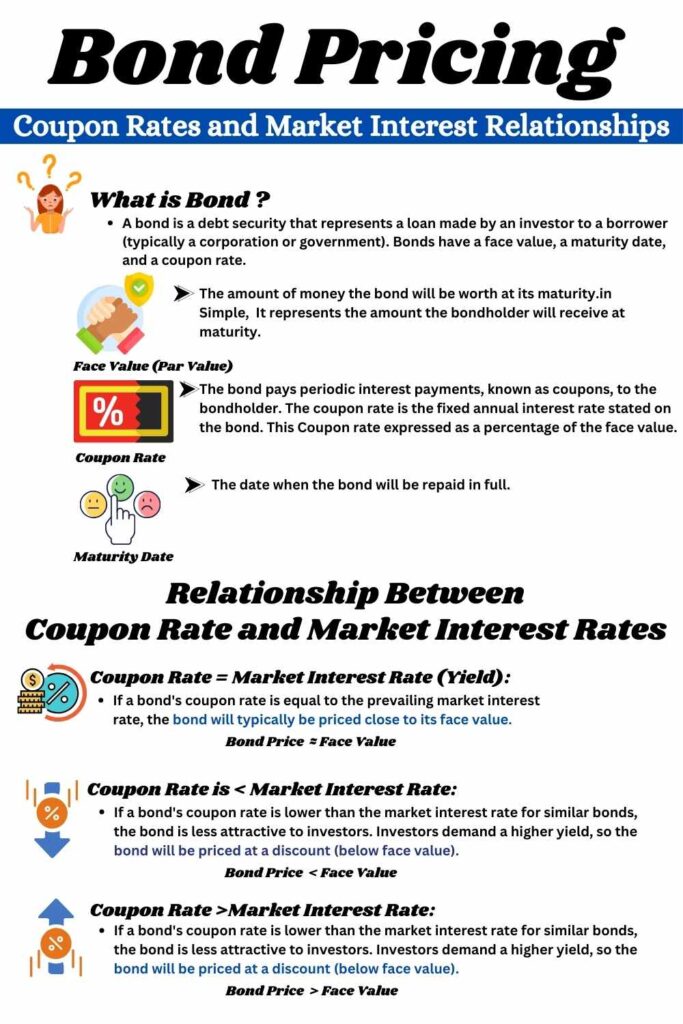

A bond is a debt security that represents a loan made by an investor to a borrower (typically a corporation or government). Bonds have a face value, a maturity date, and a coupon rate.

- Face Value (Par Value): The amount of money the bond will be worth at its maturity.in Simple, It represents the amount the bondholder will receive at maturity.

- Coupon Rate: The bond pays periodic interest payments, known as coupons, to the bondholder. The coupon rate is the fixed annual interest rate stated on the bond. This Coupon rate expressed as a percentage of the face value.

- Maturity Date: The date when the bond will be repaid in full.

Basics of Bond Pricing:

When a company or government issues a bond, they are essentially borrowing money from investors. Bonds typically have a face value, also known as par value or principal, which is the amount that will be repaid to the bondholder at maturity.

The market value of a bond can fluctuate based on various factors, one of the most significant being changes in interest rates.

Bond Pricing and Yield:

The price of a bond in the secondary market is influenced by changes in interest rates. The relationship between a bond’s coupon rate and the prevailing market interest rate determines whether the bond will sell at a premium, par, or discount.

Relationship Between Coupon Rate and Market Interest Rates:

When a bond is issued, its coupon rate is fixed. However, market interest rates (yield) may change over time due to economic conditions.

- Coupon Rate Equals Market Interest Rate (Yield):

- If a bond’s coupon rate is equal to the prevailing market interest rate, the bond will typically be priced close to its face value.

- Coupon Rate is Less Than Market Interest Rate:

- If a bond’s coupon rate is lower than the market interest rate for similar bonds, the bond is less attractive to investors. Investors demand a higher yield, so the bond will be priced at a discount (below face value).

- Coupon Rate is Greater Than Market Interest Rate:

- If a bond’s coupon rate is higher than the market interest rate, the bond becomes more attractive. Investors are willing to pay a premium (above face value) for the higher coupon payments.

Examples:

Example 1: Bond with a Coupon Rate Lower than Market Rate

- Bond A has a face value of Rs1,000 and a 9% coupon rate.

- Current market interest rates for similar bonds are 11%.

In this case, Bond A is less attractive because it offers a lower interest rate compared to the market. Investors can get a higher yield with other bonds, so they are not willing to pay the full face value for Bond A. Therefore, Bond A will sell below its face value.

Example 2: Bond with a Coupon Rate Higher than Market Rate

- Bond B has a face value of Rs1,000 and an 11% coupon rate.

- Current market interest rates for similar bonds are 9%.

Bond B is more attractive because it offers a higher interest rate compared to the market. Investors are willing to pay a premium for this higher-yielding bond. Therefore, Bond B will sell above its face value.

Example 3: Bond with a Coupon Rate Equal to Market Rate

- Bond C has a face value of Rs1,000 and an 10% coupon rate.

- Current market interest rates for similar bonds are 10%.

Bond C is in line with market rates. Investors will likely be willing to pay the face value for Bond C since its coupon rate matches the prevailing market rate.

In summary, the relationship between a bond’s coupon rate and prevailing market interest rates determines whether the bond will be priced above, at, or below its face value. it is important for investors to understand the interrelationship between a bond’s fixed coupon rate and fluctuating market interest rates in the secondary market.

If the coupon rate is lower than market rates, the bond will typically sell at a discount (below face value); if the coupon rate is higher, the bond may sell at a premium (above face value). It’s a balancing act in the financial world, where investors carefully consider these factors to make informed decisions.

By understanding this fundamental concept, newcomers to the bond field can navigate the market with a clear understanding of how prices are determined. Happy investing!